Estimating the Structural Shifts in the Demand for the Selected Food Groups in Pakistan

Research Article

Estimating the Structural Shifts in the Demand for the Selected Food Groups in Pakistan

Mehreen Zaidullah1* and Hina Fatima2

1Mirpur University of Science and Technology, Mirpur, AJK, Pakistan; 2Fatima Jinnah Women University, Rawalpindi, Punjab, Pakistan.

Abstract | Pakistan is the fastest urbanizing country among all of the South Asian Countries and its rural population may equalize that of the urban till 2030. There are other changes as well like population growth and the wealth effects that have been observed in Pakistan. These changes can affect the consumption pattern of the people, and hence result in the food demand shifts. The current study estimates for the presence of structural shifts in the demand for food in Pakistan for the selected food groups from the Household Integrated Economic Survey for the years1985-86, 1993-94, 2001-02 and 2007-08. Quadratic Almost Ideal Demand System (QUAIDS) is employed to estimate the budget shares and test for these shifts. The results confirm for the significance of the quadratic variables in the model except for the Oils’ group. The presence of these shifts have been proved in Pakistan and hence there are other factors as well like urbanization that causing these shifts in food demand, apart from the changes in expenditures and the relative prices. Hence, agricultural import and export, and farm related policies should be made harmonious with the changing population statistics and pacing urbanization in Pakistan to make this transition period smooth.

Received | August 16, 2016; Accepted | October 01, 2016; Published | October 31, 2016

*Correspondence | Mehreen Zaidullah, Mirpur University of Science and Technology, Mirpur, AJK, Pakistan; Email: [email protected]

Citation | Zaidullah, M., and H. Fatima. 2016. Estimating the structural shifts in the demand for the selected food groups in Pakistan. Sarhad Journal of Agriculture, 32(4): 343-353.

DOI | http://dx.doi.org/10.17582/journal.sja/2016.32.4.343.353

Keywords | Structural shift, Urbanization, Food demand, QUAIDS, Pakistan

Introduction

With the economic development, phenomena of urbanization, changes in composition of family and structure of age as well as the structural shifts in the output and employment composition, take place (Lluch et al., 1977). The changes in consumption patterns in response to changing incomes have been a central issue in the Balanced Growth theories of Rosenstein-Rodan (1943) and Nurkse (1959). This issue has also attracted the focus of Unbalanced Growth theories like of Lewis (1955). Then the structural change models by Chenery (1960), (1965), Taylor (1969) and Kelly et al. (1972) also took great interest in the changing consumption patterns. Kuznets (1966) observed the importance of relative prices on consumption patterns and concluded the substantial and differential effects on the final demand of various types of goods due to changes in relative prices. But, Kelley et al. (1972) argued that ignoring the factors like systematic changes in urbanization, family size and population growth that are the part and parcel of economic development, may mask their distinctive effects on demand and hence be incorporated in demand analysis along with income effect.

Over the last two decades, Pakistan’s economy has undergone many changes. Pakistan is the fastest urbanizing country in the South Asia and till 2030, its urban population may equal the rural one (UNFPA, 2007). Between 2000 and 2008, economic growth averaged 7%, millions of new jobs were created and there was huge migration to urban areas for availing the enhanced job opportunities in manufacturing and service sectors (Haq, 2009) (http://www.riazhaq.com/2009/09/urbanization-in-pakistan-highest-in.html). So consumption patterns are changing resulting in a process termed as “Structural Shift”.

These shifts as elaborated by Huang and Bouis (2001) specifically are the changes in the preference structure, due to the structural transformation of societies. Urbanization plays the key role.

But, with the increasing world population and urbanization, the quantity of net buyers is increasing day by day. The responsibility of feeding them is on rural and peri-urban dwellers whose productive capacity to cope with altered demand patterns is limited by factors like changes in land use and competition for irrigation water (Matuschke, 2009).

Hence, it is important to analyze the consumption basket of households over a long period, investigate the factors that pave way for such changes, to estimate demand elasticities which elaborate the level of demand by individual consumers given the structure of relative prices faced, real income and individual characteristics (Mittal, 2006).

Consumer demand has remained an issue of concern for Pakistani researchers. Many have tried to explore it with different methodologies, data and commodities. There have been researches as earlier as in 60s. From Rehman (1963) to Malik et al. (1988), there were many researches done on consumer food demand.

Rehman (1963) used linear double log model for estimating expenditure elasticities for rural Pakistan using survey data for rural households with food and nonfood commodities. Siddiqui (1982), Malik (1982) and Malik and Ahmed (1985) used log linear model for their studies on consumer demand for food and nonfood commodities. Siddiqui (1982) grouped HIES 1971-72 data for estimating expenditure and cross price elasticities, while, Malik (1982) with grouped HIES 1971-72 and Malik and Ahmed (1985) with Grouped HIES 1979, estimated expenditure elasticities for food and nonfood commodities in rural and urban areas of Pakistan. Malik (1982) and Malik and Ahmed (1985) also employed double log and semi log models.

The problem with these models is this that they violate the condition of Engel aggregation which is of serious concern when whole system of equations is estimated (Yoshihara, 1969). Later, the system approach replaced the single equation modeling in Pakistan. Linear Expenditure System (LES) by Stone (1954) and Extended Linear Expenditure System by Lluch (1973) were employed due to many of their advantages in analysis of consumer demand. Quantities of subsistence level can be obtained using these systems (Burki, 1997).

Ahmed and Ludlow (1987) and Ahmed et al. (1988) employed LES, while, Ali (1985) employed ELES for estimation of consumer demand and expenditure and price elasticities in Pakistan. However, LES does not permit goods to be inferior, demand elastic and gross substitutes. Also Engel curves so obtained are straight lines (Boer and Paap, 2009).

Aldermann (1988) analyzed consumer food demand in Pakistan with 1979 HIES data Using Almost Ideal Demand System (AIDS) of Deaton and Muelbauer (1980). This model is superior to previous models as axioms of choice are exactly satisfied and there is perfect aggregation over the consumers. Also by imposing linear restrictions on fixed parameters, homogeneity and symmetry restrictions can be checked through AIDS (Deaton and Muelbauer, 1980)

One of the most important issues in consumer demand analysis is of changes in diet patterns. Internationally there have been many researches on the changing food demand patterns and structural shifts in food demand.

Huang and Bouis (2001) differentiated between structural shift effect from price and income effects. These shifts as elaborated by them specifically are the changes in the preference structure due to the structural transformation of societies. The main role is played by accelerating urbanization. According to Pingali (2004), economic growth, urbanization and changes in life style are the main determinants of changes in food demand.

There are striking changes in the consumption patterns of food in Asian countries under demographic and economic transition (Shetty, 2002). In Asia there has been drastic rise in the demand for animal based products (FAO, 2003).

Cranfield et al. (1998) studied the changes in the global food demand structure with the data of International Comparison Project 1985. A sample of six countries including Pakistan was selected with high, low and normal per capita income. Huang and Bouis (2001) analyzed the structural shift in demand for food in Asia taking Taiwan as a case study using household level survey data for 1981 and 1991 on five food commodities. Mittal (2006) tested for the structural shift in the demand for food in India and made future projections using National Sample Survey organization data for the years 1983, 1987-88, 1993-94 and 1999-2000 taking aggregate food commodities.

Although, these studies used different models and methodologies but all confirmed a shift in the demand for food in Asian countries. Only two prominent studies have been done in Pakistan for the investigation of structural shift in food Demand. Burki (1997) tested for the presence and nature of structural shift in the demand for eight food commodities in Pakistan, using the annual time series disappearance data from 1972 to 1991. Aziz and Malik (2006) estimated consumer demand for meat group and its responsiveness to income and price variations in addition to taste changes, for Pakistan using time series data from 1950-51 to 2003-04.

Both these studies employed LA-AIDS with time series data and concluded that there has been structural shift in demand for food in Pakistan especially towards chicken (Burki, 1997), beef and mutton (Aziz and Malik, 2006). Both the studies proved that non-income and non- price factors infact do affect the demand for food. These studies lacked the disaggregated information as contained in HIES data because of using time series data. In the study by Aziz and Malik (2006), the coverage was limited in commodities and expenditure groups. However, Burki (1997) analysis covered much more area with almost the same methodology. Keeping in view the limitation mentioned in previous studies, the current study estimates for the presence of such shifts in Pakistan.

Materials and Methods

Four Household Integrated Economic Survey (HIES) data sets have been used i.e. for the years 1985-1986, 1993-94, 2001-02 and 2007-08. The data have been obtained from Pakistan Bureau of Statistics, Islamabad. The period of analysis is of almost about twenty years. These data sets are combined to get a pooled data set. This is done so to detect and estimate for the structural changes in food demand for different food groups in Pakistan, which is only possible with the help of time series or panel of cross-section data sets (Burki, 1997).The food commodities are taken by groups. These are cereal, pulses, vegetables and fruits named Vegfruit here, sugar and sugar products, here named together as Sugars, cooking oils and ghee named Oils, milk and milk products named Milks, meat fish and egg named MFE and other food items named Other foods here. The commodities in individual food groups are those which are given in HIES data sets of the respective years. This is worth mentioning that the HIES 1985-86 and HIES 1993-94 are much different from the HIES 2001-02 and HIES 2007-08. Many of the commodities’ quantities were not reported in the earlier data sets. The quantities were necessary to find prices from the data. The quantities of the food commodities that were not reported in the data were with little arbitration, assigned to the respective households using price statistics for those commodities, taken from Pakistan Bureau of Statistics. Also the units of measurement in the earlier data sets, for many food commodities were different than what are taken in latest HIES data. Like the quantities of beverages and vinegar are taken in bottles in HIES 1993-94. The conversion into liters was done taking aid of internet and a small survey from the people who used to consume these in 1993-94 and are consuming now as well. The other food items’ group is included to satisfy budget constraint and adding up restriction. It contains a broad group of items from readymade food items and bakery products to condiments and spices. The results of this group are not given here in results’ section as the interpretation for results of such varied and broad ranged group will hardly bear any real world implications.

Various versions of AIDS are being used in latest researches throughout the world but the current study employs Quadratic Almost Ideal Demand System by Banks et al. (1997). Quadratic Almost Ideal Demand System (QUAIDS), developed by Blundell et al. (1993) and then refined by Banks et al. (1997) is one of the AIDS’ extensions. Internationally this model has been used in numerous studies due to a number of its attractive features and superiority over other models in practice. Unlike AIDS and Translog model, it permits goods to be necessities at some income levels and luxuries on some others. Also it is a rank three demand system which makes it very flexible (Banks et al., 1997). According to Cranfield et al. (2003), generally empirical results from in- and out-of sample comparisons favour rank three demand systems over those having rank two. According to Soregaroli et al. (2002), consumption behaviour of macro-aggregates like food, tobacco and beverages, housing, recreation and transport are best represented by a rank-three demand system. It also allows for the Engel curvature and the models that fail to account for it present misguiding estimates of welfare changes due to tax alterations (Banks et al., 1997).

There are two stages. In the first one, Ordinary Least Square (OLS) estimation is done for estimating per capita food expenditures. Second stage estimation is done using seemingly unrelated regressions (Zellner, 1962).

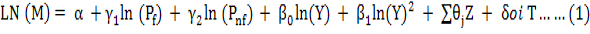

QUAIDS assumes nonlinearity of the total expenditures. The model used is quadratic in percapita expenditures, so is named as Quadratic AIDS or quad-AIDS. For modeling consumption behavior of households, a two stage budgeting framework is used. Following Blundell et al. (1993), Banks et al., (1997), Kumar (2004), Mittal (2006) and Dey et al., (2008) the methodology and functional form used in this study follows; In the first stage, following food expenditure function is estimated using OLS regression following Dey (2000), Kumar (2004) and Mittal (2006).

Where;

M: Percapita food expenditures; Y: Percapita total expenditures; (Y)2: Percapita total expenditures’ square; Pf: Household specific price index for food; Pnf: price index for non-food; Z: Ratio of adults in households, family size and urban dummy; T: Time trend.

Household specific price index for food is found as geometric mean of food prices (∑WilnPi). Where Wi is the share of ith item in total food expenditures and lnPi is the natural log of ith item’s price (Dey et al. 2008).

OLS regression is used as it is simple and its performance of time series cross section (TSCS) model parameter estimates is very well in much practical researches (Beck and Katz, 1995). This regression has been used widely at first stage of a two stage budgeting frame work by a number of researchers in food demand analysis like Kumar et al. (2005), Mittal (2006), (2010), Dey et al. (2008) and Sheng et al. (2010) . Also its results are consistent compared to Feasible Generalized Least Squares (FGLS) method which was designed to remove problems of TSCS data but creates problems instead and requires time periods to be twice or even thrice the cross-section units (Beck and Katz, 1995).

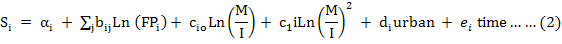

Following Banks et al. (1997), Mittal (2006) and Dey et al. (2008), the functional form adopted for the taken food groups i.e. cereal, pulses, vegetables and fruits, sugar and sugar products, cooking oils and ghee, milk and milk products, meat fish and egg and other food items, is as follows:

For the budget shares of eight food groups, eight separate equations, each of functional form as of Equation 2 are estimated using Iterated Seemingly Unrelated Regression (ITSUR). With twelve independent variables for each equation, a total of 96 parameters are estimated.

Where;

Si: Estimated share of ith food group in total food expenditures (for all i=1,2,….,8); FPi: price for ith group (for all i=1,2,….,8); M/I: Estimated per capita food expenditure from stage one, deflated by stone’s geometric price index; I: Stone’s Geometric Price Index; Urban: Binary dummy for urban areas; Time: Trend variable used to reflect tastes and preferences; Stone’s Geometric Price Index: lnI= ΣWilnp

Where;

Wi: The budget shares of individual food group in total food expenditures; Lnp: Natural log of the prices of individual food groups. Model parameters will be estimated by imposing the Homogeneity, Symmetry and adding-up restrictions for all the eight equations.

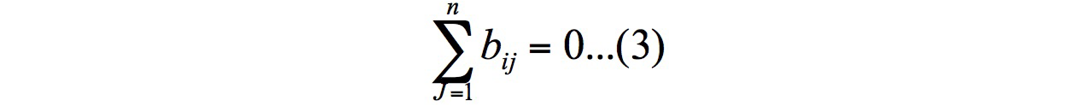

Homogeneity

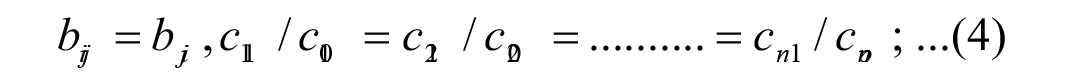

Symmetry

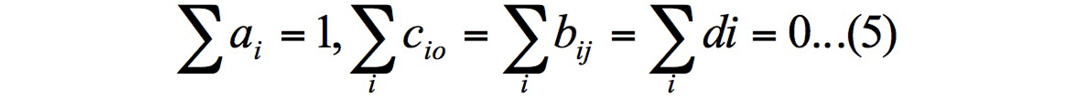

Adding Up

Table 1: Estimated Food Expenditure Function, Pakistan (HIES 1985-86, 1993-94, 2007-08 and 2001-02)

| Co-efficient | Standard Error | Z-Value | P> IZI | |

| Intercept | -1.492 | 0.021 | -71.25*** | o.oo |

| Ln Food Price Index | 0.673 | .01300 | 50.03*** | o.oo |

| Ln non-food price Index | -0.571 | 0.003 | -202.96*** | o.oo |

| Ln Percapita Total Expenditures | 1.641 | 0.007 | 216.78*** | o.oo |

| Ln Percapita Total Expenditure Square | -0.013 | 0.001 | -20.73*** | o.oo |

| Family size | -0.016 | 0.001 | -25.73*** | o.oo |

| Adult Ratio | -0.005 | 0.005 | -0.99 | 0.32 |

| Urban Dummy | 0.003 | 0.003 | 0.94 | 0.35 |

| Trend | -0.088 | 0.004 | -22.99*** | o.oo |

Adjusted R2 : 0.916; Significance level is denoted by ***: for 1%; No. of Observations: 51117

Homogeneity and symmetry restrictions are estimated at the sample mean while the adding up one will be imposed in computing the parameters of last equation which will be deleted to avoid singularity problem.The predicted per capita food expenditures, obtained at the first stage, act as explanatory variable at the second stage.

Results and Discussion

At the very first stage, per capita food expenditures are estimated. The results are shown in Table 1. All the variables are statistically significant at 99% in affecting per capita food expenditures except for the adult ratio and urban dummy, for which the p-value is even greater than 30%. This means that the ratio of adults in household and urbanization have no significant impact on per capita food expenditures in Pakistan as predicted from pooled data of four HIES survey data sets. Due to the demographic transition in Pakistan, the ratio of adults in household has not grown to the level that it can affect demand for food. Similar case can be with the degree of urbanization till yet. Food price index (FPI) represents own price effect. This effect has a positive sign as per our expectations. This means that an increase in food prices leads to higher expenditures on food. Percapita nonfood expenditures, used as proxy for nonfood price index (Dey et al., 2008), represent substitution effect and have a negative sign. This means that an increase in prices of nonfood items leads to decrease in per capita food expenditures. Percapita total expenditures, used as proxy for per capita total income (Blundell et al., 1993), are positively related to percapita food expenditures. Blundell et al. (1993) said that households distribute total expenditures among consumption of different goods rather than income. This means that an increase in consumer’s income leads to increase in per capita food expenditures. In this very case, food expenditures increase more than increase in income. Percapita total expenditure square has negative relation with the per capita food expenditures. This supports Engel’s Law that at higher level of incomes, consumers increase the consumption of luxury goods and decrease the consumption of food items relative to income (Lluch et al., 1977; Cranfield et al., 1998). Family size is also negatively related to overall food demand. With the fixed family income, lesser proportion of food expenditures is devoted to each family member with the addition of a new member in the household (Mittal, 2006). The trend variable represents tastes and preferences. This variable is also significant with a negative coefficient. This means that over almost the past twenty years, the preference for food demand in Pakistan has changed. Now people devote lesser proportion of their incomes to food expenditures. This is also according to expectations as over the past two decades there has been a wealth effect experienced in Pakistan.

The second stage estimation is carried out using QUAIDS. The estimated parameters are reported in Table 2. Intercepts of expenditure shares of all the food groups are statistically significant indicating an exogenous shift in demand for all the food groups which is independent of changes in prices and income. The intercept for the cereals is negative indicating an exogenous decline in demand for cereals in Pakistan over the period of analysis. All the intercepts though significant, but are smaller in magnitude. This means that this is the right time to take suitable measures about production and supply of these food items, otherwise there will be little room for more prudent decisions in coming future when the shift will be much greater in magnitude.

Table 2: Parameters of Second Stage Estimation by QUAIDS

| Food Groups | Cereals | Pulses | MFE | Milks | Oils | Sugars | Vegfruit |

| Intercept | -0.12 | 0.07 | 0.13 | 0.31 | 0.15 | 0.14 | 0.21 |

| (-10.11)*** | (32.06)*** | (17.9)*** | (25.8)*** | (28.93)*** | (27.97)*** | (38.4)*** | |

| Natural Log Food Prices (Rs/Kg) | |||||||

| Cereals | 0.032 | -0.002 | -0.009 | -0.0086 | 0.0003 | -0.004 | -0.0086 |

| (30.99)*** | (-10.9)*** | (-16.2)*** | (-13.6)*** | (0.60) | (-10.8)*** | (-18.4)*** | |

|

Pulses |

-0.002 | 0.022 | -0.005 | -0.004 | -0.004 | -0.0038 | -0.003 |

| (-10.9)*** | (109.7)*** | (-26.8)*** | (-26.0)*** | (-20.7)*** | (-23.0)*** | (-14.9)*** | |

| MFE | -0.009 | -0.005 | 0.065 | -0.012 | -0.004 | -0.0089 | -0.0124 |

| (-16.22)*** | (-26.8)*** | (106.4)*** | (-28.1)*** | (-11.9)*** | (-25.9)*** | (-31.0)*** | |

| Milks | -0.0086 | -0.004 | -0.0117 | 0.036 | -0.006 | 0.0008 | -0.0075 |

| (-13.6)*** | (-26.1)*** | (-28.1)*** | (48.09)*** | (-19.7)*** | (2.69)*** | (-22.5)*** | |

| Oils | 0.0003 | -0.004 | -0.004 | -0.006 | 0.022 | -0.0077 | -0.115 |

| (0.60) | (-20.7)*** | (-11.9)*** | (-19.6)*** | (72.8)*** | (-24.9)*** | (-32.4)*** | |

| Sugars | -0.0044 | -0.004 | -0.0089 | 0.0008 | -0.0077 | 0.029 | -0.005 |

| (-10.8)*** | (-23.0)*** | (-25.8)*** | (2.69)*** | (-24.9)*** | (74.41)*** | (-15.4)*** | |

| Vegfruit | -0.0086 | -0.003 | -0.012 | -0.0075 | -0.011 | -0.005 | 0.05 |

| (-18.4)*** | (-14.9)*** | (-31.1)*** | (-22.5)*** | (-32.4)*** | (-15.4)*** | (92.3)*** | |

| Otherfoods | 0.0009 | -0.0001 | -0.014 | 0.0011 | -0.015 | -0.0003 | -0.0018 |

| (1.86)* | (-0.60) | (-35.4)*** | (3)*** | (-42.0)*** | (-0.81) | (-5.06)*** | |

| Ptexp | 0.16 | -0.011 | -0.023 | -0.022 | -0.0023 | -0.015 | -0.036 |

| (36.02)*** | (-12.8)*** | (-8.08)*** | (-4.81)*** | (-1.15) | (-7.94)*** | (-17.4)*** | |

| Ptexps | -0.015 | 0.0009 | 0.0025 | 0.002 | 0.0001 | 0.0008 | 0.003 |

| (-36.4)*** | (11.8)*** | (9.97)*** | (5.93)*** | (0.47) | (5.18)*** | (16.11)*** | |

| Urban | -0.036 | -0.002 | 0.012 | -0.0036 | 0.012 | -0.006 | 0.004 |

| (-34.09)*** | (-10.4)*** | (17.4)*** | (-3.3)*** | (24.85)*** | (-14.2)*** | (7.7)*** | |

| Trend | -0.0115 | -0.005 | -0.003 | -0.007 | 0.03 | 0.0067 | 0.0025 |

| (-20.8)*** | (-46.7)*** | (-8.4)*** | (-13.2)*** | (91.5)*** | (26.9)*** | (9.49)*** | |

Values in parentheses represent Z-values; Significance level is denoted by ***: for 1%, **: for 5% and *: for 10%; Vegfruit: Vegetables and fruits; MFE: Meat, fish and eggs; Ptexp: Percapita total expenditures; Ptexps: Percapita total expenditures’ square

The results also confirm our quadratic specification of the model in all the cases except for the oils. Bopape and Myers (2007) also failed to reject a linear relationship between per capita total expenditures and share of oils in total expenditures. The urban dummy is also significant in all the cases but with a negative sign in case of Cereals, Pulses, Milks and Sugars. This shows the negative impact on the expenditures on these food groups in case the household is an urbanite. The coefficient of urban dummy for MFE, Oils, Vegfruit and Otherfoods is positive indicating a rise in expenditures on these food groups in case the household is an urbanite. The trend variable represents tastes and preferences. This variable is also significant but negative for cereals, pulses, milks and meat, fish and egg. This means that people in Pakistan have changed their preferences against these food groups over the period of analysis. These declined demands due to changes in tastes and preferences, except for the cereals are somewhat against expectations. One possible and logical reason seems to be this that the prices for food commodities had risen enormously in 2007-08, the last period included in panel for the estimation.

Apart from price issue, it has been analyzed that the demand for the cereals is definitely declining with urbanization and changing preferences, but that of pulses, sugars and milk and milk products are also declining here due to the fact that commodities are taken in aggregate groups. The demand for some of the items in a food group might be declining but others’ be rising in the same food group. The disaggregation of these food groups into individual commodities and into rural and urban divide will make pictures more clear. But, overall the demand has risen exogenously as shown by positive and significant intercepts except for the cereals.

The coefficients of own price variable for all the shares of food groups, are highly significant at 99% with a positive sign. This indicates that households maintain the share of these food groups in total expenditures even in case of price rise (Mittal, 2006). Previous studies on food demand also obtained positive coefficients of own price variable (Burki, 1997; Aziz and Malik, 2006).

The cross price effect is negative in majority of the cases. The coefficients of prices of Pulses, MFE, Milks, Sugars and vegetables and fruits are significant at 99% with a negative sign and that of other foods is significant at 10% with a positive sign, in affecting the demand for cereals in Pakistan. The price of oils has no significant impact on the demand for cereals even at 90%. Excluding Oils, a rise in prices of all the food groups will lead to a decline in demand for cereals except for the other foods where the relation is positive. The price of MFE will affect the demand for the cereals greater than all other taken food groups. Bopape and Myers (2007) also found a negative relation of grains demand with the prices of dairy products, Sugars and vegetables and fruits.

All the coefficients of cross prices other than otherfoods’ group, in the share equation for pulses are significant at 99% with a negative sign indicating the decline in demand for pulses due to rise in these prices. Burki (1997) found a negative relation between the demand for split mung pulse and prices of milk and mutton.

The entire cross prices in the share equation for MFE are statistically significant at 99% with coefficients of minus signs. This means that rise in prices of all other taken food groups will cause the share of MFE in the budget to decline. Burki (1997) also found a negative relation between the demand for mutton and prices of chicken, fish and fresh milk.

The case of milk and milk products is bit different from the MFE group. Though significant at 99%, all the cross prices do not bear negative signs. The coefficients of prices of cereals, pulses, MFE, oils and vegetables and fruits are negatively signed but those of sugars and other foods are positive. This means that a rise in each cross price will reduce Milks (Milks group includes milk and milk products) demand other than sugars and other foods, which will elevate milks’ demand.

As the price of oils is insignificant in affecting the demand for cereals, the price of cereals is also insignificant in affecting oils’ demand. All other cross prices are highly significant at 99% in the budget share equation for the oils and their signs indicate a decline in demand for oils due to the increase in their prices. Bopape and Myers (2007) did the demand analysis for South Africa while Mittal (2006) did so for India. Bopape and Myers (2007) found negative relation between oils demand and the prices of meat and dairy products, while Mittal (2006) found negative relation between demand for oils and prices of pulses and sugars.

The budget share equation of sugar and sugar products contains all the negatively signed cross price coefficients with significance at 99% except for the other foods which are insignificant at all and milks’ group which though highly significant, bears positive relation with sugars’ demand. Mittal (2006) found negative relation of demand for sugars with the prices of cereals and oils. Bopape and Myers (2007) found negative relation between the prices of grains and, vegetables and fruits, and the demand for sugars. But, Mittal (2006) and Bopape and Myers (2007) also found positive relation between milks’ price and sugars’ demand as this study did. Frequent reference of the current study to the estimates of Bopape and Myers (2007) and Mittal (2006) is made because both these studies are much similar to the current study in model, methodology and commodity gouping and aggregation. Unfortunately such study in Pakistan is not existent for referencing.

Lastly, every cross price coefficient in the share equation of vegetables’ and fruits’ group is significant at 99% and bears negative sign, indicating the decline in demand for the vegetables and fruits due to rise in the prices of all the food groups other than vegetables and fruits itself. Mittal (2006) and Bopape and Myers (2007) found negative relation between prices of Milks and MFE and demand for the vegetables and fruits.

Conclusions

This study uses pooled data set of four HIES data sets for the years 1985-86, 1993-94, 2001-02 and 2007-08 to test for the structural shift in demand in Pakistan for the selected food groups. A two stage budgeting frame work is adopted. This framework uses Ordinary Least Squares at the first stage to estimate percapita food expenditures and Quadratic Almost Ideal Demand system at the second stage to estimate the budget shares and structural shift in demand for food groups, taken. The results indicated the presence of these shifts in the demand for all the food groups with an exogenous decline in demand for cereals and an exogenous rise for all other food groups. Hence, it has been shown that that only the changes in expenditures and relative prices alone do not account for the changes in the demand for food commodities in Pakistan. The results also support an evidence of correctness of our quadratic specification of the model except for the oils.

At present, Pakistan is facing an inadequacy of existing water resources to meet the requirements of water especially for the irrigation purpose and prospects for the near future do not show an optimistic picture as well in terms of greater availability of water (PWP, 2001). Growing population and limited availability of water and land are exerting great pressure on our economy (Ahmed et al., 2006).

Changing life styles and growing demand for balanced diet in Pakistan have increased meat demand reasonably. But increasing exports of meat has decreased the supply of meat to the local markets and hence exponential increase in meat prices (Ayub et al., 2011).

The domestic demand for milk is also not met by the total domestic production Unfortunately Pakistan imports powdered milk to meet domestic demand despite being one of the leading milk producers of the world. Each year Pakistan spends almost US$ 380 million on imports of powdered milk. Projections for fresh milk production in 2009-10 show a deficit of fresh milk production over domestic demand (Burki et al., 2004).

Between 1950 and 1998, the consumption (in thousand tons) of edible oils in Pakistan has risen by 1565% while during the same period, production (in thousand tons) has risen by just 453% approximately (Chaudhary et al., 1998). The production of edible oils in 2004-05 was 1.08 million tons short of domestic consumption requirement (http://prr.hec.gov.pk/chapters/2043-1.pdf). This gap will further widen up to 3.4 million tons by 2030 in current state of economic and agricultural affairs (Zaman et al., 2010).

Though the demand for the sugar and sugar products is also rising, the domestic production situation is satisfactory (Shafique, 2013). Vegetables’ demand is in excess over vegetables supply in Pakistan resulting in higher current prices (Adil et al., 2012). In 2007, there was a shortage of 0.6295 million tons of onion in Pakistan (Ibid). The shortage is met by imports from India (Ibid). The domestic supply of fruits was enough to meet domestic demand in 2010-11 (HIES, 2010-11 and PBS, 2011) (http://www.pbs.gov.pk/sites/default/files/agriculture_statistics/publications/Agricultur

al_Statistics_of_Pakistan_201011/tables/table58.pdf ).

Though the demand for cereals is declining, but indirect demand for these is rising due to growing demand for livestock feed, as Pakistani meat is now consumed in greater quantities domestically and abroad. On the other hand, domestic supply is far below the required demand level especially in case of wheat. Recent floods on one hand and price surges on the other hand are making poor more vulnerable. There is immediate need to resolve issues in disaster management and water conservation to ensure appropriate and sustained supply of irrigation water and hence cereals in near and distant future as well.

There is also a greater need for enhanced research and development expenditures on agriculture in Pakistan. Those varieties of crops and livestock have to be developed and used that require lesser water, have greater dietary benefits and are best suited to the local environment.

These are just few suggestions but if worked in time with proper planning, demand and supply gaps will be reduced and ultimately terminated in the coming future. The foreign exchange will be economized for spending on development projects. Narrow gap between demand and domestic supply of food commodities will prevent food inflation. Hence easy availability and access to food for all the segments of society will be ensured, even for the most vulnerable one.

Though the analysis done here is on aggregate commodities, further analysis by disaggregation of these food groups will make picture more clear and targeted policy actions easier.

The estimates with the model specification better suited to consumer demand yields more reliable results. This study has used QUAIDS for estimating the food demand in Pakistan. The results confirmed the suitability of a rank three demand system for the food demand analysis.

Authors’ Contribution

Both the authors have contributed substantially to the current research work. The idea was conceived by the main author. Data extraction is done by the main author, but the estimation has been carried out by the joint effort of the both. The coauthor has also accompanied the main author in drafting the document, interpretation of the results and suggesting the improvements where needed.

References

Adil, S.A., S.A Maqsood, K. Bakhsh, and Hassan, S. 2012. Forecasting demand and supply of onion in Pakistani Punjab. Pak. J. Agri. Sci. 4 9(2): 205-210.

Ahmad, E., and S. Ludlow. 1987. Aggregate and regional demand response patterns in Pakistan. Pak. Dev. Rev. 26(4): 645-657.

Ahmad, E., S. Ludlow and N. Stern. 1988. Demand response in Pakistan: A modification of the Linear Expenditure System for 1976. Pak. Dev. Rev. 27(3): 293-308.

Ahmed, S., Alam, N., Shakoor, A and Ullah, M.K. 2006. Meeting future food demands of Pakistan under scarce water situations,Pakistan Engineering Congress 70th Annual Session Proceedings

Alderman, H. 1988. Estimates of consumer price response in Pakistan using market price as data. Pak. Dev. Rev. 27(2): 89-107.

Ali, M.S. 1985. Household consumption and saving behaviour in Pakistan: An application of extended linear expenditure system. Pak. Dev. Rev. 24(1): 23-38.

Ayyub. R.M., M. Bilal and M. Ahmed. 2011. Meat price hikes and its forecasting in Pakistan. J. Anim. Plant Sci. 21 (2): 256-259.

Aziz, B., and S. Malik. 2006. Surmising consumer demand & structural changes using time series data. Pak. Econ. Soc. Rev. 44(1): 117-136.

Banks, J., R. Blundell and A. Lewbel. 1997. Quadratic engel curves and consumer demand. Rev. Econ. Stat. 79(4):527-539.

Beck, N., and J.N. Katz. 1995. What to do (and not to do) with time-series cross-section data? Am. Polit. Sci. Rev. 89(3): 634-647. http://dx.doi.org/10.2307/2082979

Blundell, R., P. Pashardes and G. Weber. 1993. What do we learn about consumer demand patterns from micro data? Am. Econ. Rev. 83(3): 570-597.

Boer, P.D., and R. Paap. 2009. Testing non-nested demand relations: Linear expenditure system versus indirect addilog. Statistica Neerlandica. 63(3): 368-384. http://dx.doi.org/10.1111/j.1467-9574.2009.00429.x

Bopape, L., and R. Myers. 2007. Analysis of household demand for food in South Africa: Model selection, expenditure endogeneity, and the influence of socio-demographic effects, African Econometrics Society Annual Conference, Cape Town, South Africa, July 4-6.

Burki, A.A. 1997. Estimating consumer preferences for food using time series data of Pakistan. Pak. Dev. Rev. 36(2): 131-153.

Burki, A.A., M.A. Khan and F. Bari. 2004. The state of Pakistan’s dairy sector: An assessment. Pak. Dev. Rev. 43(2): 149–174.

Chaudhry, M.G., A.Mahmood and G.M. Chaudhry. 1998. Pakistan’s edible oil needs and prospects of self-sufficiency. Pak. Dev. Rev. 37(4): 205-216.

Chenery, H.B. 1960. Patterns of industrial growth. Am. Econ. Rev. 50: 624-654.

Chenery, H.B. 1965. The Process of Industrialization. Paper presented to the First World Congress of the Econometric Society, Rome.

Cranfield, J.A.L., J.S. Eales, T.W. Hertel and P.V. Preckel. 1998. Changes in the structure of global food demand. Am. J. Agri. Econ. 80: 1042-1050. http://dx.doi.org/10.2307/1244202

Cranfield, J.A.L., J.S. Eales, T.W. Hertel and P.V. Preckel. 2003. Model selection when estimating and predicting consumer demands using international, cross section data. Empir. Econ. 28: 353–364. http://dx.doi.org/10.1007/s001810200135

Deaton, A., and J. Muellbauer. 1980. An almost ideal demand system. Am. Econ. Rev. 70: 312-326.

Dey, M. M. 2000. Analysis of demand for fish in Bangladesh. Aquac. Econ. Manage. 4: 63-81. http://dx.doi.org/10.1080/13657300009380261

Dey, M.M., Y.T. Garcia, P. Kumar, S. Piumsombun, M.S. Haque, L. Li, A. Radam, A. Senaratne, N.T. Khiem and S. Koeshendrajana. 2008. Demand for fish in Asia: Across-country analysis. Aust. J. Agric. Resour. Econ. 52: 321–338. http://dx.doi.org/10.1111/j.1467-8489.2008.00418.x

FAO, 2003. World agriculture: Towards 2015/2030 (ed. J. Bruinsma), Earthscan Publications, London. pp. 432.

Government of Pakistan (GoP) 1986. Household integrated economic survey. Federal Bureau of Statistics, Islamabad.

Government of Pakistan (GoP) 1994. Household integrated economic survey. Federal Bureau of Statistics, Islamabad.

Government of Pakistan (GoP) 2001. Household integrated economic survey. Federal Bureau of Statistics, Islamabad.

Government of Pakistan (GoP) 2008. Household integrated economic survey. Federal Bureau of Statistics, Islamabad.

Government of Pakistan (GoP) 2011. Household integrated economic survey. Federal Bureau of Statistics, Islamabad.

Haq, R., and N. Arshad. 2010. Inequality and welfare by food expenditure components. Pakistan Institute of Development Economics, Islamabad.

Haq, R. 2009. Urbanization in Pakistan: Highest in South Asia [Blog post]. Retrieved fromhttp://www.riazhaq.com/2009/09/urbanization-in-pakistan-highest-in.html

Huang, J., and H. Bouis. 2001. Structural changes in the demand for food in Asia: Empirical evidence from Taiwan. Agri. Econ. 26: 57–69. http://dx.doi.org/10.1111/j.1574-0862.2001.tb00054.x

Kelley, A.C., J.G. Williamson and R.J. Cheetham. 1972. Dualistic economic development. University of Chicago Press, Chicago and London.

Kumar, P. 2004. Fish demand and supply projections in India, report of ICAR-ICLARM project strategies and options for increasing and sustaining fisheries and aquaculture production to benefit poor households in Asia. Division of Agricultural Economics, Indian Agricultural Research Institute, New Delhi.

Kumar, P., M.M. Dey and J. Paraguas. 2005. Demand for fish by species in India: Three stage budgeting framework. Agri. Econ. Res. Rev. 18: 167-186.

Kuznets, S. 1966. Modern economic growth. Yale University Press, New Haven, Conn.

Lluch, C. 1973. The Extended Linear Expenditure System. Eur. Econ. Rev. 4: 21–32. http://dx.doi.org/10.1016/0014-2921(73)90028-7

Lluch, C., A.A. Powell and R.A. Williams. 1977. Patterns in household demand and saving. Oxford University Press, United States of America.

Lewis, W.A. 1955. The theory of economic growth. Allen and Unwin, London.

Malik, S. 1982. Analysis of consumption patterns in Pakistan. Pak. Econ. Soc. Rev. 20(2): 108-122.

Malik, S.J., M. Mushtaq and E. Ghani. 1988. Consumption pattern of major food items in Pakistan: Provincial, Sectoral and Intertemporal Differences 1979 to 1984-85. Pak. Dev. Rev. 27(4): 751-766.

Malik, S., and R. Ahmad. 1985. Analysis of household consumption in Pakistan. Govt. College Econ. J. 28(1,2): 97-106.

Matuschke, I. 2009. Rapid urbanization and food security: Using food density maps to identify future food security hotspots. International Association of Agricultural Economists Conference held August 16-22, Beijing, China.

Mittal, S. 2006. Structural Shift in Demand for Food: Projections for 2020. Indian Council for Research on International Economic Relations (ICRIER), Working Paper 184.

Mittal, S. 2010. Application of the QUAIDS model to the Food Sector in India. J. Quant. Econ. 8(1): 42-54.

Nurkse, R. 1959. Patterns of trade and development. The Wicksell Lectures, Almquist and Wiksell, Stockholm.

Pingali, P. 2004. Westernization of Asian diets and the transformation of food systems: Implications for research and policy (ESA Working Paper No. 04-17). Agricultural and Development Economics Division, FAO.

PWP, 2001. Supplement to the Framework for Action (FFA) for achieving the Pakistan Water Vision 2025. Pakistan Water Partnership (PWP), Islamabad, Pakistan.

Rehman, A. 1963. Expenditure elasticities in rural West Pakistan. Pak. Dev. Rev. 3(2): 232-249.

Rosenstein-Rodan, P.N. 1943. Problems of industrialization of Eastern and Southeastern Europe. Econ. J. 202-11. http://dx.doi.org/10.2307/2226317

Shafiq-Ur-Rehman, M. 2013, Pakistan sugar annual, USDA Foreign Agricultural services, Global Agricultural Information Network. Retrieved fromhttp://gain.fas.usda.gov/Recent%20GAIN%20Publications/Sugar%20Annual

_Islamabad_Pakistan_4-22-2013.pdf

Sheng, T.Y., M.N. Shamsudin, Z.M. Mohammed, A.M. Abdullah and A. Radam. 2010. Demand analysis of meat in Malaysia. J. Food. Prod. Market. 16 (2): 199-211. http://dx.doi.org/10.1080/10454440903415105

Shetty, P.S. 2002. Nutrition transition in India. Pub. Health Nutr. 5(1A): 175-182. http://dx.doi.org/10.1079/PHN2001291

Siddiqui, R. (1982). An analysis of consumption pattern in Pakistan. Pak. Develop. Rev. 21(4): 275-296.

Soregaroli, C., K. Huff and K. Meilke. 2002. Demand system choice based on testing the Engel Curve specification,Department of Agriculture Economics and Business, University of Guelph, Guelph, Ontario.

Stone, R. H. 1954. Linear Expenditure System and the Demand Analysis: An application to the pattern of British demand. Econ. J. 64: 511–527. http://dx.doi.org/10.2307/2227743

Taylor, L.1969. Development Patterns: A simulation study. Q. J. Econ. 83: 220-241. http://dx.doi.org/10.2307/1883081

UNFPA, 2007. Life in a city: Pakistan in focus. United Nations Fund for Population Activities (UNFPA), Pakistan Institute of Development Economics (PIDE), Islamabad.

Yoshihara, K. 1969. Demand Functions: An application to the Japanese expenditure pattern. Econometrica. 37: 257-274. http://dx.doi.org/10.2307/1913535

Zaman, S.B., S. Majeed and A. Shahid. 2010. Retrospect and prospects of edible oil and Bio-Diesel in Pakistan: A Review. Pak. J. Agri. Sci. 23: 3-4.

Zellner A. 1962. An efficient method of estimating seemingly unrelated regressions and tests for aggregation bias. J. Am. Stat. Assoc. 57: 348-375. http://dx.doi.org/10.1080/01621459.1962.10480664

To share on other social networks, click on any share button. What are these?