Does the Quantity and Quality of Cereal Respond to Changes in Income? Evidence from Pakistan

Research Article

Does the Quantity and Quality of Cereal Respond to Changes in Income? Evidence from Pakistan

Mohammad Fayaz, Abbas-ullah Jan, Dawood Jan, Ghaffar Ali1 and Yousaf Hayat

1Department of Agricultural & Applied Economics, The University of Agriculture, Peshawar; 2Department of Maths, Stats and Computer Sciences, The University of Agriculture, Khyber Pakhtunkhwa, Peshawar.

Abstract | This study used log-log-inverse specification of Engel curve for cereals’ quantity and quality response to households’ income in Pakistan. The elasticities of interest (quantity, expenditure and quality) were inelastic with reasonable difference in magnitude across urban and rural households. Overall, the quality elasticity turned out to be positive with an estimated value of 0.0061 and 0.2375 for wheat & wheat flour and rice & rice flour, respectively. The estimation of quality elasticity based upon income quintiles revealed that the magnitude of quality elasticity increases for rice & rice flour (0.2019 to 0.2639) while decreases for wheat & wheat flour (0.0160 to -0.0012) as household move from poorest to richest quintile indicating an increased responsiveness of the high-income households to rice quality compared to wheat.

Received | April 04, 2016; Accepted | June 07, 2016; Published | August 20, 2016

*Correspondence | Mohammad Fayaz, Department of Agricultural & Applied Economics, The University of Agriculture, Peshawar, Pakistan; Email: [email protected]

Citation | Fayaz, M., A. Jan, D. Jan, G. Ali and Y. Hayat. 2016. Does the quantity and quality of cereal respond to changes in income? Evidence from Pakistan. Sarhad Journal of Agriculture, 32(3): 177-183.

DOI | http://dx.doi.org/10.17582/journal.sja/2016.32.3.177.183

Keywords | Cereal consumption, Quantity elasticity, Expenditure elasticity, Quality elasticity, Urban/rural households, Pakistan

Introduction

Pakistani populace has a high dependence on cereals to meet the daily requirement of food energy. Cereals account for 47 percent of the total per capita calorie supply and 46 percent the per capita protein supply in Pakistan (FAO, 2011). Similarly, expenditure on cereal consumption accounts for about 20 percent of total household food expenditure (approximately 15 percent on wheat and 4 percent on rice) in Pakistan. Poor households spend a larger proportion (23%) of their income on wheat. However, the share of expenditure on rice (4 percent) is almost the same for households in different income groups (GoP, 2009).

Per capita income (in dollars) of Pakistan has increased at an annual rate of 6.4 percent during the last half decade (GoP, 2012), shows a reasonable boost in the purchasing power. The concept that a rational consumer moves from quantity to quality especially when higher quality food becomes more affordable with higher income, reflecting change in consumer tastes and preferences consistent with basic economic theory (Deaton, 1997). Household income and food consumption has been investigated worldwide extensively and systematically since long with focus mainly on income and expenditure elasticity ignoring the important factor of quality. A review of literature is evidence for the limited studies with focus on quality effect in food consumption, concluding that households are willing to pay a higher price for enhanced quality with the increase in income. Apart from Jan et al. (2008a), Jan et al. (2008b) and Jan et al. (2009) there is no empirical work on food quality in Pakistan; however, these studies are focused only on fruits and milk consumption. Furthermore, these studies have highlighted the need for further exploration of quality response to changes in household income on the basis of income quintiles and urban/rural comparisons to have a deeper insight of the issue. Keeping in view the importance of cereals in households’ food consumption that has shaped a higher demand for cereals in Pakistan, the study in hand is designed with the following objectives:

- 1. To estimate quantity, expenditure and quality elasticity for cereals in Pakistan.

- 2. To provide a comparison of cereals quality response of urban and rural households.

- 3. To assess the cereals quality response across income quintiles.

Data and Methodology

This study used Log-log inverse (LLI) form of Engel curve to study cereals’ quantity and quality response to households’ income as linear and semi-logarithmic forms have some conceptual problems. For example, in Linear Engel equation the inferior goods tend to become luxuries with increasing expenditure (Dawoud, 2005), which do not reflect an exact picture of the individual behaviour (Tey et al., 2009). Similarly, the semi-log functional form assumes constant income elasticity overall level of income, which is not conceivable.

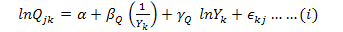

Log-log inverse (LLI) functional form of Engel equation was presented by Hicks and Johnson (1968) and Hassan and Johnson (1977) followed by Gale and Huang (2007), to capture the quality effect. Similarly, Jan et al. (2008a), Jan et al. (2008b), Jan et al. (2009), Tey et al. (2008), Tey et al. (2009), Yu and Abler (2009) and Ogundari (2012) used the same methodology to capture a nonlinear relation of households’ consumption and income that let the income elasticity to vary with income level. The nonlinear estimates of Engel curve may reflect physical saturation of demand, which presents more reasonable estimates of demand elasticities. Additionally, the LLI approach is suitable when income elasticities decline to zero with rising income/total expenditure (Gale and Huang, 2007). Following their models, a nonlinear relationship of consumption (Qj) and income (Y), the following models can be used.

Where;

j represents the jth cereal, k is the kth household, Q j is the quantity of jth cereal consumed by household, α, β and γ are the coefficients to be estimated and ϵ is disturbance term. Similarly, for expenditure (Ej) and income (Y) relationship.

Equation (i) can be modified as:

Where;

Ej represents household expenditure on jth cereal and other defined as earlier.

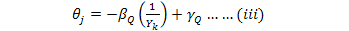

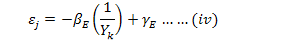

Equations (i) and (ii) would give estimates of parameters α, β, γ. If β is equal to zero, the LLI model turns to double log model, indicating constant income elasticities. Similarly, if γ is equal to zero, LLI model turns to log inverse model and income elasticity equals –βQ (1/Yk). Also income elasticity varies with income but it never reaches to zero or change sign. However, if both β and γ are not equal to zero, then elasticities are worked out, as follows:

Quantity elasticity (θj ):

Expenditure elasticity (εj ):

Quality elasticity (φj ) is computed as the difference between Expenditure elasticity (εj) and Quantity elasticity (φj ):

![]()

Additionally, this study follows Gujrati (2003) procedure for testing structural differences across regions in order to check whether pooled (urban and rural) data on households or different models should be estimated for urban and rural areas.

Households’ Income

To reflect the permanent income of the households, total expenditure was used as proxy of income in this study (Friedman, 1957). Similarly, Tansel (1986), Cinar (1987), Manig and Moneta (2009), Ravillion (1992), Cheema (2005) and Jan et al. (2009) also used the same proxy to reflect the households’ income. Further, the respondents were divided in to five equal groups/quintiles based on the values of total expenditure, similar to Jan et al. (2009). The quintiles are describes as follow:

1st Quintile (Q1) = Lowest 20% - Poorest

2nd Quintile (Q2) = Low middle 20%

3rd Quintile (Q3) = Middle 20%

4th Quintile (Q4) = Upper Middle 20%

5th Quintile (Q5) = Highest 20% - Richest

Table 1: Number of observations, households’ monthly mean consumption and expenditure

| Cereals | Region |

Number of Obser- vation |

Mean Consumption (in Kg) |

Mean Expenditure (in PKR) |

| Wheat & Wheat Flour | Overall | 16181 | 54.718 | 1572.94 |

| Urban | 6506 | 48.986 | 1448.806 | |

| Rural | 9675 | 58.573 | 1656.415 | |

| Q1 | 6165 | 39.511 | 1125.566 | |

| Q2 | 3895 | 54.874 | 1582.904 | |

| Q3 | 2915 | 64.203 | 1859.419 | |

| Q4 | 2124 | 75.746 | 2169.93 | |

| Q5 | 1082 | 73.970 | 2125.312 | |

| Rice & Rice Flour | Overall | 15262 | 7.512 | 401.814 |

| Urban | 6312 | 6.560 | 380.75 | |

| Rural | 8950 | 8.184 | 416.670 | |

| Q1 | 5791 | 4.812 | 235.039 | |

| Q2 | 3683 | 7.872 | 400.559 | |

| Q3 | 2759 | 9.305 | 492.250 | |

| Q4 | 2008 | 10.982 | 618.347 | |

| Q5 | 1021 | 9.862 | 682.039 |

Source: PSLM-2010-11

Data Used

Household Integrated Economic Survey (HIES) part of Pakistan Social and Standards Living Measurement (PSLM) 2010-11 data set including a sample size of 16341 households was used for this study. Data available on cereals (wheat & wheat flour and rice & rice flour) consumption is given in Table 1.

Results and Discussion

Models Estimates and Diagnostics

Keeping in view the nature of the data used all the equations were estimated using STATA-12 version with robust option. This option gives robust standard errors that can effectively deal with normality, heteroscedasticity, or some observations that exhibits large residuals. However, a fairly large sample size (> 100) relaxes the normality assumption (Gujrati, 2003).

The models were estimated separately for urban and rural region as the Chow’s test p-value of 0.000 (Table 2) suggesting that statistically significant difference between urban and rural quantity/expenditure models exists.

Table 2: Estimates of Chow’s F-test

| Cereals | Quantity | Expenditure | ||

| F-value | p-value | F-value | p-value | |

| Wheat & Wheat Flour | 560.524 | 0.000 | 411.822 | 0.000 |

| Rice & Rice Flour | 115.516 | 0.000 | 104.632 | 0.000 |

Empirical observations with reasonable range of Coefficient of determination (R2) along with significant F-statistics in all equations (Table 3 and 4) are accepted (Gujrati, 2003; World Bank, 2005) for good fitness of the model.

Coefficients given in equations (iii) and (iv) were found statistically significant (p-value less than significance level (0.05)) that confirm the LLI functional form of the Engel curve fits the data well for cereals in Pakistan (Table 3 and 4).

Quantity, Expenditure and Quality Elasticities

The estimates of quantity income elasticities of wheat & wheat flour, rice & rice flour were 0.3269 and 0.4917,

Table 3: Estimates of quantity equation

| Item/region |

α |

Standard Error |

βQ |

Standard Error |

γQ |

Standard Error |

F-ratio |

R2 |

|

| Wheat & Wheat flour | Overall |

5.893* |

0.388 |

-9119.534* |

557.03 |

-0.141* |

0.036 | 1180.15 | 0.216 |

| Urban |

7.525* |

0.409 |

-11408.6* |

654.439 |

-0.316* |

0.038 | 402.47 | 0.128 | |

| Rural | 0.469 | 0.436 |

-4503.227* |

536.624 |

0.394* |

0.041 | 2218.64 | 0.407 | |

| Rice & Rice flour | Overall |

1.606* |

0.344 |

-9792.172* |

505.772 | 0.057 | 0.032 | 1518.07 | 0.148 |

| Urban |

1.510* |

0.470 |

-9788.489* |

847.492 | 0.053 | 0.043 | 532.04 | 0.141 | |

| Rural |

-1.319* |

0.632 |

-7361.599* |

781.352 |

0.353* |

0.060 | 1131.86 | 0.179 | |

*: significant at five percent significance level

Table 4: Estimates of expenditure equation

| Item/region |

α |

Standard Error |

βQ |

Standard Error |

γQ |

Standard Error |

F-ratio |

R2 |

|

| Wheat & Wheat Flour | Overall |

9.260* |

0.389 |

-9333.805* |

562.133 |

-0.145* |

0.036 | 1251.23 | 0.225 |

| Urban |

11.056* |

0.399 |

-11669.56* |

638.701 |

-0.329* |

0.037 | 429.49 | 0.132 | |

| Rural |

4.165* |

0.449 |

-4888.287* |

555.885 |

0.361* |

0.043 | 2137.91 | 0.395 | |

| Rice & Rice Flour | Overall |

3.478* |

0.326 |

-9002.603* |

478.332 |

0.277* |

0.030 | 2793.02 | 0.252 |

| Urban |

3.352* |

0.444 |

-9061.377* |

785.357 |

0.278* |

0.041 | 1087.23 | 0.256 | |

| Rural |

1.187* |

0.594 |

-7118.716* |

737.089 |

0.510* |

0.056 | 1835.54 | 0.273 | |

*: indicates significant at five percent significance level

respectively. For urban households, the estimated quantity-income elasticity of wheat & wheat flour and rice & rice flour were 0.1681 and 0.4093 respectively. Similarly, for rural households the quantity elasticity of wheat & wheat flour and rice & rice flour were calculated 0.6634 and 0.7836, respectively (Table 5). The higher values of quantity elasticity in term of magnitude for rural households compared to the urban households showing that rural households are more sensitive in cereals consumption to changes in their income. Quantity income elasticities calculated at various quintiles decreased from 0.7501 to 0.0157 for wheat & wheat flour and 0.9331 to 0.1645 for rice & rice flour as household move from the poorest quintile to richest (Table 5).

Table 5: Quantity, expenditure and quality elasticity of the cereals

| Cereal Region | Quantity Elasticity | Expenditure Elasticity | Quality Elasticity | |

| Wheat & Wheat Flour | Overall | 0.3269 | 0.3330 | 0.0061 |

| Urban | 0.1681 | 0.1661 | -0.0020 | |

| Rural | 0.6634 | 0.6522 | -0.0111 | |

| Q1 | 0.7501 | 0.7661 | 0.0160 | |

| Q2 | 0.4221 | 0.4304 | 0.0083 | |

| Q3 | 0.2805 | 0.2855 | 0.0050 | |

| Q4 | 0.1662 | 0.1685 | 0.0023 | |

| Q5 | 0.0157 | 0.0144 | -0.0012 | |

| Rice & Rice Flour | Overall | 0.4917 | 0.7292 | 0.2375 |

| Urban | 0.4093 | 0.6569 | 0.2475 | |

| Rural | 0.7836 | 0.9261 | 0.1426 | |

| Q1 | 0.9331 | 1.1350 | 0.2019 | |

| Q2 | 0.5932 | 0.8225 | 0.2293 | |

| Q3 | 0.4446 | 0.6859 | 0.2413 | |

| Q4 | 0.3234 | 0.5744 | 0.2511 | |

| Q5 | 0.1645 | 0.4284 | 0.2639 | |

The expenditure elasticities in term of magnitudes were 0.1661 for wheat & wheat flour and 0.6569 for rice & rice flour in case of urban households. For rural households, the estimates of expenditure elasticities were 0.6522 for wheat & wheat flour and 0.9261 for rice & rice flour. Generally, the magnitudes of expenditure elasticities for urban households were lower than rural households. Similar to Quantity elasticities, expenditure elasticities at different income quintiles also decreased as households move from lowest quintile to highest.

The quality elasticity for rice & rice flour was positive for both urban (0.2475) and rural (0.1426) households while negative quality elasticities were obtained for wheat & wheat flour in case of urban households (-0.0020) and as well as rural (-0.0111) ones. The quality elasticity estimated across the income quintiles has increased in term of magnitude for rice & rice flour (0.2019 to 0.2639) while decreased for wheat & wheat flour (0.0160 to -0.0012) as households move from poorest quintile to richest one. The estimation of quality elasticity based upon income quintiles reveal that the magnitude of quality elasticity increases for rice & rice flour while decreases for wheat & wheat flour as household move from poorest to richest quintile. This shows that Pakistani households are paying higher prices for quality rice as compare to wheat among cereals. The findings of this study are parallel to the results of Gale and Haung (2007), Jan et al. (2008a), Jan et al. (2008b), Jan et al. (2009), Tey et al. (2008), Tey et al. (2009), Yu and Abler (2009) and Ogundari (2012). Empirical results for quantity elasticities in their study showed that the log-log inverse specification fits the food consumption data well, showing a greater similarity to the findings of this study. Comparison on the basis of urban/rural household income, food consumption and elasticities in this study is another similarity to the findings of the reference studies. The estimates of quantity and expenditure elasticities obtained in our study are different in magnitudes but still consistent with the results of their studies in terms of being inelastic. The quality elasticities calculated in their studies are similar in signs to our estimates but different in magnitudes.

Conclusion

Overall, the estimates of quantity and expenditure elasticities remained less than unity, indicating that cereals were treated as essential. The larger estimates of quantity and expenditure elasticity of rural households compared to the urban for both the cereals indicated that households in rural region more sensitive in cereals consumption to changes in their income. The magnitude of quality elasticity for the rice & rice flour remained positive and decreased for rural households compared to urban ones. The estimation of quality elasticity based upon income quintiles revealed that the magnitude of quality elasticity increased for rice & rice flour while decreased for wheat & wheat flour as household moved from poorest to richest quintile. This implies that household tends to spend more on rice & rice flour compared to wheat & wheat flour as their income rise. In general, the evidence of positive quality elasticities indicates that consumers in Pakistan pay a higher price for quality cereals. Therefore, an extensive study is recommended to identify those quality attributes for which the consumers are willing to pay a higher price. Furthermore, all the stakeholders involved in the cereals supply chain should focus on quality enhancement if they are going to harvest increased earnings.

Authors’ Contribution

This paper is a part of first author’s PhD research work. Dr. Abbas Ullah Jan was major supervisor in PhD research and Dr. Dawood Jan was member supervisory committee from major field. Dr. Ghaffar Ali and Dr. Yousaf Hayat helped in data compilation and analysis.

References

Alderman, H., and M. Garcia. 1993. Poverty, household food security, and nutrition in rural Pakistan. International Food Policy Research Institute. Research report No. 96.

Burney, N.A., and A.H. Khan. 1991. Household consumption patterns in Pakistan: An urban rural comparison using micro data. Pak. Develop. Rev. 30(4): 145-171.

British Nutrition Foundation (BNF). 2004. Nutritional Aspects of Cereals, Final Report to the Home Grown Cereal Authority, BNF, London. Pp. 5-6.

Cinar, M. 1987. The sensitivity of extended linear expenditure system: Household scales to income declaration errors. J. Economet. 34: 181-194. http://dx.doi.org/10.1016/0304-4076(87)90019-4

Cheema, I.A. 2005. A profile of poverty in Pakistan, Centre for Research on Poverty Reduction and Income Distrib, Islamabad. www.cprid.org

Calvin, L., F. Gale, D. Hu and B. Lohmar. 2006. Food safety improvements underway in China. Amber Waves. 4(5): 16-21.

Chai, A. and A. Moneta. 2010a. Retrospectives engel curves. J. Econ. Perspect. 24(1): 225–240. http://dx.doi.org/10.1257/jep.24.1.225

Chai, A. and A. Moneta. 2010b. The evolution of Engel curves and its implications for structural change, Discussion Paper, Griffith Business School.

Dawoud, S. 2005. An analysis of food consumption patterns in Egypt, PhD dissertation. Available on www.d-nb.info/975462458/34. Visited March 17, 2014.

Deaton, A. 1997. The analysis of Household Surveys: A micro econometric approach to development policy. Baltimore USA: John Hopkins University Press.

Douglas, M., and B. Isherwood. 1996. The world of goods: Towards an anthropology of consumption. (2nd ed.). Routledge, London.

Friedman, A. 1957. A theory of consumption function, Princeton University Press, Princeton.

Gale, F., and K. Huang. 2007. Demand for food quantity and quality in China. Economic Research Report No. 32. Economic Research Service, United States Department of Agriculture (USDA).

Government of Pakistan. 2012. Economic Survey of Pakistan 2011-12. Economic Advisory Wing Finance Division, Islamabad.

Government of Pakistan. 2008-09. Pakistan Social and Living Standard Measurement Survey 2007-08’, Pakistan Federal Bureau of Statistics, Islamabad.

Government of Pakistan. 2010-11. Pakistan Social and Living Standard Measurement Survey 2010-11, Pakistan Federal Bureau of Statistics, Islamabad.

Gujarati, D. N. 2003. Basic Econometrics, fourth edition, McGra-Hill inc. NY, USA, p. 109-110 and 275-279.

FAO (Food and Agriculture Organization). 2011. Food Balance Sheets. Accessed December 2011. http://faostat.fao.org/site/368/default.aspx

Houthakker, H.S. 1957. An international comparison of household expenditure patterns. Econometrica. 25 :532-551. http://dx.doi.org/10.2307/1905382

Hicks, W.W., and S.R. Johnson. 1968. Quantity and quality components for income elasticities of demand for food. Am. J. Agri. Econ. 50: 1512-1517. http://dx.doi.org/10.2307/1237349

Hassan, Z., and S.R. Johnson. 1976. Consumer demand for major food in Canada. Ottawa, Ontario: Economics Branch, Agriculture Canada.

Hassan, Z., and S.R. Johnson. 1977. Urban food consumption patterns in Canada, Ottawa, Ontario: Economics Branch, Agriculture Canada.

Hussain, A. 1991. Resource use, efficiency and returns to scale in Pakistan: A case study of Peshawar valley. Staff Paper Series P91-29, Department of Agricultural and Applied Economics, University of Minnesota, USA.

Haque, M.O. 2006. Functional forms for Engel curves. Income elasticities and economic development: Methods and applications published by Springer P.O. Box 17, 1300A Dordercht, The Netherlands. Pp. 31-32.

Huang, K.S., and F. Gale. 2009. Food demand in China: Income, quality, and nutrient effects. China Agri. Econ. Rev. 1(4): 395-409. http://dx.doi.org/10.1108/17561370910992307

Islam, A., and C. Siwar. 2005. Impact of the financial crises on expenditure patterns in Malaysia: Special reference on low-income households. J. Econ. Res. 10: 145-173.

Johnson, S.R., and A.N. Safyurtlu. 1984. A demand matrix for major food commodities in Canada, Columbia, Missouri: Department of Agricultural Economics, University of Missouri.

Jan, A.U., A.F. Chishti and M. Khan. 2008. Estimating consumers’ response to quality: A case of Pakistan fruits, The proceeding of International Conference on Applied. Economics – ICOAE 2008. Pp. 411-414.

Jan, A., D. Jan, G. Ali, M. Fayaz and M. Khan. 2009. Consumers’ response to milk quality: A comparison of urban and rural Pakistan. Sarhad J. Agri. 25(2): 329-332.

Jan, D., P.R. Eberle, A. Jan, G. Ali and M. Khan. 2009. Absolute poverty in Pakistan: Where are the poor concentrated? Sarhad J. Agri. 25(2): 321-327.

Jan, A., A.F. Chishti, D. Jan and M. Khan. 2008a. Estimating consumers’ response to food quality in Pakistan: A case of Pakistan fruits. Sarhad J. Agri. 24(21): 151-154.

Jan, A., A.F. Chishti, D. Jan and M. Khan. 2008b. Milk quality in Pakistan: Do consumers care? Sarhad J. Agri. 24(2): 168-171.

Manig, C., and A. Moneta. 2009. More or Better? Measuring Quality versus Quantity Food consumption. Papers on Economics & Evolution # 0913, Max Planck Institute of Economics, Jena, Germany.

McCarthy, F.D. 1981. Quality effects in consumer behaviour. Pak. Develop. Rev. 2(20): 133-150.

Prais, S.J. and H.S. Houthakker. 1955. The Analysis of Family Budgets, Cambridge. Cambridge University Press.

Prais, S.J. and H.S. Houthakker. 1971. The Analysis of Family Budgets, 2nd Impression, Abridged, Cambridge University Press.

Ravallion, M. 1992. Poverty comparisons: A guide to concepts and methods’, LSMS Working Paper No. 88. The World Bank.

Sarma, J.S., R. Shyamal and P.S. George. 1979. Two analyses of Indian food grain production and consumption data, International Food Policy Research Institute. Research report No. 12.

Tansel, A. 1986. An Engel Curve Analysis of Household Expenditure in Turkey 1978-79. METU Stud. Develop. 13: 239-257.

Timmer, C.P., W.P. Falcon and S.R. Pearson. 1983. Food policy Analysis, Johns Hopkins University Press. Baltimore.

Tafere, K., A.S. Taffesse, S. Tamru, N. Tefera and Z. Paulos. 2010. Food demand elasticities in ethiopia: estimates using household income consumption expenditure (HICE) Survey Data. Development Strategy and Governance Division. International Food Policy Research Institute. Strategy Support Program II. Ethiopia.

Tey, Y.S., F.M. Arshad, M.N. Shamsudin, Z. Mohamed and A. Radam. 2008. Demand for meat quantity and quality in Malaysia: Implications to Australia. MPRA Paper No. 15032. Available at: http://mpra.ub.uni-muenchen.de/15032/.

Tey, Y.S., Mad Nasir, S., Zainalabidin, M., Jinap and A.R. Gariff. 2009. Demand for Quality vegetables in Malaysia. Int. Food Res. J. 16: 313-327.

Ogundari, K. 2012. Demand for quantity versus quality in beef, chicken and fish consumption in Nigeria, Department of Food Economics and Consumption Studies, University of Kiel, Kiel, Germany.

World Bank. 2000. World Development Indicators, Available at: www.worldbank.org.

World Bank. 2005. www.siteresources.worldbank.org/PovertyHCR2000-2005.pdf. www.wws.princeton.edu:80/rpds/working.htm

Yu, X. and D. Abler. 2009. The demand for food quality in rural and urban china. Am. J. Agri. Econ. 9(1): 57-69. http://dx.doi.org/10.1111/j.1467-8276.2008.01159.x

To share on other social networks, click on any share button. What are these?