Socio-Economic Development of Small Farmers by Providing Micro-Credit Facilities under the Crop Maximization Project in District Charsadda, Pakistan

Socio-Economic Development of Small Farmers by Providing Micro-Credit Facilities under the Crop Maximization Project in District Charsadda, Pakistan

Bahadar Sher Khattak1, Muhammad Kaleem1, Waqas2*, Humaira Naz1 and Muhammad Yasir3

1University of Peshawar, Khyber Pakhtunkhwa, Pakistan; 2The University of Agriculture Peshawar, Khyber Pakhtunkhwa, Pakistan; 3Sarhad University of Science and Information Technology, Khyber Pakhtunkhwa, Peshawar, Pakistan.

Abstract | The Crop Maximization Project (CMP) was initiated with the help of Government of Pakistan which aimed at uplifting the socioeconomic conditions of the small farmers through various agricultural interventions. One of the important and essential interventions of CMP was micro-credit facilities to small farmers. The current research study focused on the core objective of the CMP aimed at finding out the effect of micro-credit intervention on small farmers and how their socioeconomic status improved during the span of the project. The project was introduced to the two Union Councils (UCs), the Rajjar-II and Sarki Tetara, of District Charsadda. These two UCs were purposively selected to collect 150 samples for the study. A well-structured interview schedule was developed to collect data which was pre-tested before starting the actual process of data collection. The total sample size of the study area was 150, randomly selected for interviews. After the data analysis, it was found that the majority of the respondents (83.3%) who were small farmers acquired and utilized micro-credit in establishing income generating entrepreneurs, purchased quality seeds, fertilizers and small scale modern technology. These innovations brought substantial enhancement in their farm productivity and income that ultimately improved those farmers’ socioeconomic position. However, 16.7% of the respondents’ remains deprived of acquiring the micro-credit facilities of the project where no change in their livelihood conditions was observed. Overall, this study has significant association between the socioeconomic development of small farmers and micro-credit intervention of CMP. Based on the findings of the study, it is recommended that micro-credit facilities should be provided to all farmers under any prospective agriculture projects to achieve optimum results in farmers’ farm productivity.

Received | October 25, 2019; Accepted | February 13, 2020; Published | April 17, 2020

*Correspondence | Waqas, The University of Agriculture Peshawar, Khyber Pakhtunkhwa, Pakistan; Email: [email protected]

Citation | Khattak, B.S., M. Kaleem, Waqas, H. Naz and M. Yasir. 2020. Socio-Economic development of small farmers by providing micro-credit facilities under the crop maximization project in district Charsadda, Pakistan. Sarhad Journal of Agriculture, 36(2): 389-396.

DOI | http://dx.doi.org/10.17582/journal.sja/2020/36.2.389.396

Keywords | Micro-credit, Seed fertilizer, Small farmer, Socioeconomic development, District Charsadda

Introduction

The economy of Pakistan is dependent mainly on agriculture and it is considered the backbone of country’s economy (Rehman et al., 2015). Similarly, the livelihood of the people living in the rural areas depends on agriculture. This sector provides raw materials for industries and fulfills food demand of the people. The agriculture sector of Pakistan contributed to the country’s GDP is 18.5%, and has 38.5% of share in total employment (GOP, 2018). The sector is constantly depriving in national budget to allocate an optimum financial provision for new agricultural intervention. However, a gap between the acquired and actual output of production is exist due to lack of appropriate technology, water unavailability, inadequate education regarding insects and timely use of fertilizers are several reasons which negatively affect the amount of production (Rehman et al., 2015).

The livelihood of the people living in the rural areas depends on agriculture. This sector provides raw materials for industries and fulfills food demand of the people.

Major contributor in agriculture are small farmers, however, their socioeconomic conditions generally remain vulnerable. Most of the small farmers they have no other means of income and their economy always rely on the subsistence nature of agriculture. Hence, their saving capacity remains very weak or is nonexistent. Research study conducted by Rao (1995), demonstrated that more than one billion of small farmers of the world are living in severe poverty, and one fifth of them sleep empty stomach each night. This study further explored its results that main causes of their social and economic vulnerability are lack of extra income generation intervention and relies on conventional small scale agriculture. The recommendations of the study asserted that small farmers should be provided micro-credit facilities to enable them to establish extra income generation, agriculture base interventions and to purchase improved agricultural inputs to enhance their farm production. It will positively lift their social and economic conditions.

(Ansoms et al., 2010) also supported the above statement by reporting that the intense poverty prevailing among small farmers can be only controlled through providing them financial and technical support. In another study regarding the socioeconomic condition uplift conducted by Yazhari (2016), it was confirmed that micro-credit facilities play a pivotal role to eradicate the poor status of farmers. The farmers should be provided micro-credit facilities through simple and easy procedures. Availability of micro-credit facilities will further promote farm productivity by adopting the modern practices in their conventional agriculture. Moreover, (Alila and Atieno, 2006), observed that the Kenya government initiated a project to improve the farmers’ economic conditions, however, for this purpose the respective government provided micro-credit to small farmers for two main sectors. First, farmers should purchase best quality of agricultural inputs in order to enhance crop production. Secondly, the project helped the farmers by diversifying their income with the help of income generating interventions. Further, it brought changes into the farmer’s socioeconomic status that ultimately helps the country’s food security.

One important consideration is reflected in a report of a World Bank published in 2013 in respect of socioeconomic uplift of farmers. Likewise, the report of Food and Agriculture Organization (FAO, 2011) published in 2011 also under pins the above statement by indicating that the easily accessible micro-credit facilities to small farmers can play very significant role in enhancing the farm production of small farmers (FAO, 2011). Through micro-credit they can increase their crop production by purchasing the in time and improved agricultural inputs. Moreover, they can establish income generating entrepreneur for the proliferation of their returns and income that will eventually enhance the socioeconomic status as well. Shepherd (1998) study revealed the causes and consequences of meager conditions of small farmers because of non-availability of micro-credit facilities. He explained that small farmers have no option for their livelihood improvement other than improving less productive agriculture. In this context, a study conducted by (Ansoms et al., 2010) revealed that in order to diversify the income of small farmers, micro-credit facilities through simple procedure should be made available that helps take some productive measures for enhancing their farm production. It will bring revolutionary changes in their social and economic conditions. Provision of micro-credit facilities improved the farmers’ socioeconomic condition (Mohsin et al., 2011). The study further found that the provision of micro-credit facilities helps out the farmers to protect them from the slavery of middle men as well as agricultural input suppliers.

Miller (2004) revealed that the small farmers of America have very stable socioeconomic conditions as compared to the rest of the world. According to the result of the study, the main factor behind this phenomenal stability is the availability of abundant micro-credit and skill enhancement opportunities for them. Their economy is diversified through a variety of income generating interventions. The government and the development organizations provide them frequent financial and technical support in this regard.

However, small farmers in Pakistan face persistent poverty (Sahibzada, 1997). According to the study the main cause of poverty associated with farmers is the scarcity of cash capital. There is no proper system of permanent micro-credit facility and the availability of micro-credit for agriculture sector. Therefore, the financial requirements of small farmers are then fulfilled by the middle men, money lenders and the input suppliers etc. at the cost of their exploitation which further deteriorates their social and economic status.

The small farmers within Pakistan stand behind even the third world countries in the field of agriculture, due to lack of planning and user-friendly policies for agriculture sectors. In addition, non-availability and non-accessibility of micro-credit facilities are other factors that bring the sector on the brink of failure. However, several programs are commenced periodically to achieve the targets of the farmers’ socioeconomic on a regular basis. Crop Maximization Project (CMP) is one of the abovementioned projects which was a mega project from 2008-2012.

The Crop Maximization Project (CMP) was themed with the anticipation of the high increase in farm productivity of small farmers by intervening new technology, high quality of seeds and fertilizers. Besides all of these interventions, the project also helped the farmers to diversify their income through various income generating interventions. While keeping the food security as the top priority, the socioeconomic condition uplift was also prioritized in the CMP (Khan, 2012). In respect of the above interventions started under the CMP, provision of micro-credit facilities is one of the key interventions to improve the socioeconomic conditions of small farmers in the study area. This study also demonstrates the technical explanation of CMP that how the micro-credit facilities improve the farmers’ socioeconomic conditions.

Objective of the study

The major objective of the current study was to find out the effect of micro-credit facilities to farmers in CMP so that their condition improves socioeconomically. However, in this study no significant association was hypothesized amongst the micro-credit facilities with the development of socioeconomic conditions.

Materials and Methods

The current study was aimed at finding out the influence of interventions in the CMP in the shape of micro-credit to all those small holding small lands. Several procedures were used to determine the empirical relationship within the study variables. All procedures are described below.

Study design

This study is designed on cross sectional date called cross sectional study design or one-shot study design. This study design was selected because of time constraints. In this study, cross-sectional design helped to determine the possible relationship of the effect of micro-credit facilities by keeping the socioeconomic uplift of farmers a priority.

Study universe

District Charsadda is situated in the Peshawar division of Khyber Pakhtunkhwa, Pakistan. A project initiated on Crop Maximization was undertaken in Union Council of Titara and the Union Council Rajjar-II in District Charsadda. The main theme of the study was small farmers who were legally selected as members of the CMP.

Sampling procedure and sample size

Simple Random Sampling (SRS) procedure was used to select a representative sample from the study population based on the registered number of farmers. Total number of registered farmers with CMP was 1400 in the two UC. Through SRS technique 150 respondents were selected for data collection using the allocation proportion method.

Tools for data collection and data analysis

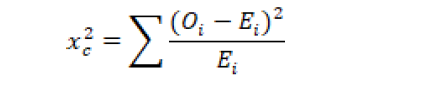

Almost all farmers were illiterate; therefore, interview schedule was carefully designed to encompass dependent and independent variables of the study. The data were analyzed through SPSS. Univariate analysis was performed through frequencies and distribution. However, for bivariate analysis, Chi-square test was used to know the association amongst the dependent and independent variables.

C, in the above chi square formula represents a degree of freedom; O, represents the observed value; E, is the expected value.

The gamma statistical test was used for testing the correlation between the categorical variables. The formula for Gamma statistical test was as under:

Results and Discussion

The results and discussion section focuses on the findings of this study. This section briefly concludes the availability of micro-credit facilities of CMP to small farmers, its utilization in agriculture sector and in other income generating interventions by them furthers its effect on their socioeconomic conditions.

Table 1: Micro-credit facilities availability in CMP interventions.

| Credit facilities provided | Frequency | Percent |

| Yes | 150 | 100.00 |

| No | 00.00 | 00.00 |

| Total | 150 | 100.0 |

Source: Author’s calculation.

Table 1 provides the information about the availability of micro-credit facilities in Crop Maximization Project interventions at District Charsadda. All of the respondents confirmed that the project included the micro-credit facilities. The notion asserted by a research study conducted by Ansoms (2008) who found that micro-credit facilities is a vibrant way of enriching the farmers and to alleviate their poverty level. The notion further extended to the role of farming community exclusively the farmers holding a small piece of land which can be benefited from micro-credit facilitation by keeping up their economic growth and poverty alleviation. Such practices are indispensable in a country whose major part is based on agriculture.

Table 2: Type of farmers got the micro-credit of CMP.

| Types of farmers | Frequency | Percent |

| Small Farmers | 150 | 100.00 |

| Big Farmers | 00.00 | 00.00 |

| Total | 150 | 100.00 |

Pretty (1995) focused on the overall agricultural projects micro-credit interventions which has the central value in the process of enhancing the economic status of small farmers. Therefore, according to the study findings in the agricultural development projects micro-credit facilities should be included to uplift the socioeconomic conditions of the farmers. The same importance of the abovementioned factor has been given in the CMP whose core aim was to improve the farmers’ condition socioeconomically.

The data in Table 2 provides the details about the type of farmers who availed the micro-credit facility under the CMP in which all respondents confirmed the provision of credit. Hazell et al. (2006) in a research on small farmers observed that the small farmers have very important role in agricultural development of a country. So, they should be provided with the micro-credit facilities to enhance their farm productivity. Reporting maximum farm production from the majority of the farmers’ subsequently their social as well as their economic status enhanced.

A research study was conducted by Khattak et al. (2016) revealed that the small farmers should be provided with credit facilities to diversify their income through different income diversification interventions. In this connection, the CMP provided various agriculture based interventions on the shape of micro-credit to all those farmers holding a small piece of lands in the study area. However, the basic purpose of this intervention was to bring a vibrant uplift in the socioeconomic status of farmers.

Table 3: Micro-credit availability to small farmers of the area in pre project era.

| Credit Availability before project | Frequency | Percent |

| Yes | 27 | 18.0 |

| No | 123 | 82.0 |

| Total | 150 | 100.0 |

Table 3 revealed the results regarding information about the micro-credit available to all those farmers holding a small piece of land. It was found under the frequencies and distributions results that 82% of the small farmers were availing the credit facilities from various banks and other firms whereas only 18% were those who do not avail the aforesaid facilities. Sahibzada (1997) described that the small farmers in Pakistan are constantly facing difficulty to access agriculture based credit. Moreover, the study further demonstrated the unavailability and far accessibility to credit facilities to farmers, which ultimately compelled them to borrow loans from money lenders on short terms and conditions. They exploit their vulnerability. This is one of the major factors responsible for the existing poverty of all the farmers within the country. It was also reported by Pehu et al. (2017) who portrayed the real cause of lower socioeconomic background of farming community in Pakistan and asserts the non-availability of credit facilities to farming community is one of the factors responsible for it. Therefore, according to the abovementioned findings the results further verified in this study along with additional outcomes. First, it was found in the CMP that majority of farmers were deprived of the credit facilities before the commencement of the project. Second, it was found that the socioeconomic status of farmers was low before the CMP. And third, the respondents were interviewed again after the completion of the project and found that a major portion of small farmers was provided the micro-credit facilities which mean that all the farmers benefited from the CMP interventions.

Table 4: Types of micro-credit provision to small farmers by CMP.

| Types of credit | Frequency | Percent |

| Micro-Credit | 125 | 83.3 |

| Macro-credit | 00.00 | 00.00 |

| No Idea | 25 | 16.7 |

| Total | 150 | 100.0 |

Table 4 shows the information classification types of credit facilities to all farmers, which showed that more than half of the respondents i.e. Farmers were provided micro-credit facilities. The 16.7% of the respondents were unaware of the credit types. Corner (1990) revealed that micro-credit is the pre-requisite to increase in farm production as well as the socioeconomic uplift of farmers. However, there is a very minute threat involved in such credit provision to the farmers, but these fears of risks are indistinct. Alam et al. (2014) also demonstrated the advantages of credit facilities which enable a farmer to increase farm productivity along with diversification of their income which ultimately improve their earning power. Eventually, their socioeconomic conditions will improve. Identifying the importance of micro-credit also included the micro-credit sector to support the small farmers who have no resources or even less resources with an aim to develop their economic as well as social conditions by increasing their farm production and income.

Table 5 depicts the utilization of information about micro-credit by targeting respondents under the Crop Maximization Project in different fields. About 9.33% of the small farmers utilized the credit for establishing the goat farm. The 22% of the respondents cultivated off season vegetables. The major portion (43.33%) of the small farmers buys improved seeds and fertilizers. About 66.6% of them purchased new agricultural technology. Marketing centers have been established only 2% of the respondents. The 25% of the small farmers got no credit. These figures indicate that the majority of small farmers utilized their credit for productive means. According to Khan (2012) through micro-credit availability to small farmers can diversify their income and can improve their livelihood. Bajwa (2004) also revealed that the credit facilities to small farmers make them able to develop their agriculture and also provide them, the chance to create extra income generating opportunities and enhanced their income. The data in the above table also indicates that if the micro-credit is provided to small farmers, they can purchase good quality of agricultural inputs and further help diversify their income by establishing extra income generating entrepreneurs. Consequently, the farm production along with farmers’ income helps uplift their socioeconomic status.

Table 5: Micro-credit was utilized in different fields by small farmers.

| Field in which the micro-credit has been utilized | Frequency | Percent |

| Goat farm | 14 | 9.33 |

| Off Season Vegetable | 33 | 22.00 |

| Improved seed and fertilizer | 65 | 43.33 |

| New technology purchase | 10 | 6.66 |

| Establishing marketing center | 3 | 2.00 |

| Any other | 00.00 | 00.00 |

| No use | 25 | 16.66 |

| Total | 150 | 100 |

Table 6: Impact of micro-credit in enhancing the socioeconomic condition of small farmers.

| Impact of micro-credit | Frequency | Percent |

| Yes | 125 | 83.3 |

| No | 25 | 16.7 |

| Total | 150 | 100.0 |

Table 6 demonstrates the information about the impact of credit facilities which showed that 83.7% of the respondents showed their satisfaction and contentment from the micro-credit intervention

Table 7: Cross tabulation showing associations between “Micro-credit” and “socioeconomic development” of small farmers.

| Impact of micro-credit on raise in socioeconomic conditions of small farmers | The socioeconomic conditions of small farmers raise to | Total | Statistics | |||

| Yes or No | To some extent | To greater extent | To less extent | No change occur | ||

| Yes | 84 | 19 | 15 | 7 | 125 | Chi-square value 50.078; P-value 0.00; Gamma value 0.00 |

| No | 2 | 1 | 11 | 10 | 25 | |

| Total | 86 | 20 | 26 | 17 | 150 | |

provided to them under the CMP while few respondents i.e. 16.7% denied the role of micro-credit, while influencing their socioeconomic status. This view underpinned, based on the view of Mehta (2009) who mentioned the utmost importance of micro-credit facilities and considers a pre-requisite for farmers’ socioeconomic development. Through micro-credit their income can be diversified. This will definitely enhance farmer’s income and their socioeconomic status would be enhanced. The commencement of CMP filled this gap to a great extent by providing the facilities in the shape of micro-credit to farmers. It has been discussed earlier that majority of respondents benefited from micro-credit facilities. Through micro-credit facilities, enhanced the farmers’ crop productivity. Majority of them convert their subsistence nature of agriculture in commercial agriculture. They established another income generating enterprise which increases their income. All these positive changes affect their social and economic conditions positively. Though some of the respondents unfortunately could not avail the facilities and hence no changes revealed on the part of their socioeconomic status. However, the overall impact of micro-credit interventions clearly shows socioeconomic uplift and influenced farmers’ status.

Table 7 highlights the results of the study showed a cross tabulation of socioeconomic development as dependent variable and micro-credit intervention as independent variable. Chi-square goodness of fit determined the association of variables. The chi-square value 50.078 and P-value 0.00 were observed in the results which are very high, revealing a strong significant association between the variables. Moreover, it means that increasing micro-credit to farmers will improve the socioeconomic condition. As mentioned earlier the high chi square value i.e. 50.078 further revealed that the null hypothesis (H0): is rejected, whereas alternative (H1): hypothesis is accepted. The gamma value, i.e. 1.00 showed that the independent and dependent variables have a direct relationship. These results have close resemblance with the result of the study of Mohsin et al. (2011) where it was found that micro-credit interventions have significant association with the improved socioeconomic condition. It was further found that continuous and maximum provision of micro-credit facilities to small farmers raise the probability of the socioeconomic condition alongside improved productivity.

The farmers established small scale entrepreneur with the help of micro-credit facilities under the CMP, whose main aim was income generation. Such practices enabled the farmers to buy agricultural inputs at the time they need and also allow them to select quality inputs for quality production. Similarly, the improved socioeconomic was the result of improved farm productivity.

Conclusions and Recommendations

Based on the findings of this study, it was concluded that the majority of the sampled respondents received the micro-credit facilities which enable to purchase improved agricultural-inputs timely which subsequently enhanced their farm productivity. Furthermore, they also utilized the micro-credit for a variety of income generating interventions which diversified their income. As a result, the farmers’ income considerably increased which ultimately improved them socioeconomically. However, some farmers’ condition was relatively same as it was before due to not availing the micro-credit facilities, nevertheless, the proportion of such respondents was extremely low.

Based on these results, it is recommended that prospective rural development projects must be equipped with micro-credit interventions. Furthermore, such interventions’ policies should be on relaxed terms and conditions to enable farmers to participate, increase their productivity, and diversify their income and improve their livelihood.

Novelty Statement

The Crop Maximization Project (CMP) achieved optimum results by providing microcredit facilities to small farmers. This project improved socioeconomic conditions of small farmers which subsequently increased farm productivity in District Charsadda, KP, Pakistan.

Author’s Contribution

Bahadar Sher Khattak developed the basic theme of the study. Muhammad Kaleem guided and supervised the overall research study. Humaira Naz helped in data collection and analysis. Waqas provided technical and formatting input. Muhammad Yasir improved final draft of the manuscript.

References

Alam, M., R. Ullah, A.I. Mirza, W. Saleem, M. Elahi and H. Sultan. 2014. Impact of microcredit scheme on socio-economic status of farmers.A case study of PRSP in District Gujranwala. S. Asian Stud., 29(1): 161.

Alila, P. and R. Atieno. 2006. Agricultural Policy in Kenya: Issues and processes. Future Agricultures Consortium Workshop. http://www.fao.org/fileadmin/user_upload/fsn/docs/Ag_policy_Kenya.pdf

Ansoms, A. 2008. A green revolution for Rwanda? The political economy of poverty and agrarian change. https://econpapers.repec.org/paper/iobdpaper/2008006.htm

Ansoms, A., A. Verdoodt and E. Van Ranst. 2010. A green revolution for rural Rwanda: reconciling production growth with small-scale risk management. http://www.chronicpoverty.org/uploads/publication_files/ansoms_et_al_rwanda.pdf

Bajwa, R. 2004. Agricultural extension and the role of the private sector in Pakistan. National Rural Support Programme, Islamabad, Pakistan. http://www.cropscience.org.au/icsc2004/symposia/4/4/1736_bajwa.htm

Corner, L. 1990. Poverty alleviation and human resources development. 90(6): 21 https://www.cabdirect.org/cabdirect/abstract/19911888750.

FAO, 2011. Pakistan and FAO Achievements and Success Stories. http://www.fao.org/fileadmin/templates/rap/files/epublications/Pakistanedoc

GoP, 2018. Economic Survey of Pakistan. Ministry of Finance, Islamabad. http://finance.gov.pk/survey/chapters_19/Economic_Survey_2018_19.pdf

Hazell, P., C. Poulton, S. Wiggins and A. Dorward. 2006. The future of small farms: Synthesis paper. Washington, DC: World Bank. https://openknowledge.worldbank.org/ handle/10986/9218 License: CC BY 3.0 IGO

Khan, A.D. 2012. Case study of special program for food security and productivity enhancement. https://www.slideshare.net/AllahDadKhan/case-study-food-security-by-allah-dad-khan.

Khattak, B.S., S.Q. Memon and M. Kaleem. 2016. Effectiveness of income diversification interventions of crop maximization project in the socio-economic development of small farmers of district Charsadda. Eur. Acad. Res. J., 71(9): 7615-7627.

Mehta, R. 2009. Rural livelihood diversification and its measurement issues: focus India. In Second meeting, Wye City Group on statistics on rural development and agricultural household income. pp. 11-12.

Miller, G.T. 2004. Living in the environment: Principles, connections, and solutions. Pacific Grove, USA. Brooks/Cole-thompson learning. pp. 116.

Mohsin, A.Q., S. Ahmad and A. Anwar. 2011. Impact of Supervised Agricultural Credit on Farm Income in the Barani Areas of Punjab. Pak. J. Soc. Sci. 31(2): 241-250.

Pehu, E., C. Belden, S. Majumdar and T. Jantunen. 2017. Increasing Crop, livestock and fishery productivity through ICT. pp. 97 – 126. https://doi.org/10.1596/978-1-4648-1002-2_Module5

Pretty, J.N. 1995. Regenerating agriculture: Policies and practice for sustainability and self-reliance. Publ. London Earthscan. pp. 197-198.

Rao, T.V. 1995. Human resources development: experiences, interventions, strategies. SAGE Publications India.

Rehman, A., L. Jingdong, B. Shahzad, A.A. Chandio, I. Hussain, G. Nabi and M.S. Iqbal. 2015. Economic perspectives of major field crops of Pakistan: An empirical study. Pac. Sci. Rev. b: Humanit. Soc. Sci., 1(3): 145-158. https://doi.org/10.1016/j.psrb.2016.09.002

Sahibzada, M.H. 1997. Poverty alleviation in Pakistan: present scenario and future strategy. Inst. Policy Stud., pp. 208-210. https://doi.org/10.30541/v36i2pp.208-210

Shepherd, A. 1998. Sustainable rural development. published by palgrave, Houndmills, Basingstoke, New Yourk, USA.

Yazhari, E. 2016. Agriculture and food security at the BOP India and East Africa. Dheli: Ben Grozier, Operations Associate.

To share on other social networks, click on any share button. What are these?