Economic Costs of Managing Climatic Risks in Agriculture: Evidences from Khyber Pakhtunkhwa Province of Pakistan

Economic Costs of Managing Climatic Risks in Agriculture: Evidences from Khyber Pakhtunkhwa Province of Pakistan

Raza Ullah1* and Jamal Shah2

1Institute of Agricultural and Resource Economics, University of Agriculture Faisalabad, Pakistan; 2Abdul Wali Khan University Mardan, Pakistan.

Abstract | Exposure of agriculture to natural environment makes this sector more vulnerable to climate changes and climate induced risks including rising temperature, changes in rainfall patterns, floods, droughts and heavy rains etc. Farmers adopt available risk coping tools to minimize the impacts of such risks at farm level however, these adoptions require farmers to incur cost or forgo part of the potential benefits from agricultural production. These costs (explicit or implicit) are referred to as the cost of risk management. Previous studies on risk management in agriculture however have ignored such costs. The present study is therefore designed to investigate how adoption of risk coping tools affect farm productivity in Khyber Pakhtunkhwa Province of Pakistan. 330 wheat growers were selected using multistage sampling technique and Analysis of Variance was used to compare the average wheat yield of farmers using different combinations of the two risk coping tools namely, off-farm diversification and precautionary savings. The results suggested that adoption of risk coping tools, particularly the simultaneous adoption of multiple tools at the same time, significantly reduced wheat yield. The research suggested that future studies should identify ways to minimize such costs associated with risk management at farm level.

Received | October 20, 2016; Accepted | December 25, 2018; Published | February 07, 2019

*Correspondence | Raza Ullah, Institute of Agricultural and Resource Economics, University of Agriculture Faisalabad, Pakistan; Email: raza_khalil@yahoo.com

Citation | Ullah, R. and J. Shah. 2019. Economic costs of managing climatic risks in agriculture: Evidences from Khyber Pakhtunkhwa Province of Pakistan. Sarhad Journal of Agriculture, 35(1): 155-160.

DOI | http://dx.doi.org/10.17582/journal.sja/2019/35.1.155.160

Keywords | Cost of risk management, Agriculture, Diversification, Precautionary savings, Agricultural credit

Introduction

The issues related to climate change and its potential impacts on human lives is echoing strongly around the globe. The potential impacts of climate change on agricultural production is of particular interest for researchers and policy makers as it may threaten the food security of masses depending directly or indirectly on this sector of the economy. Agriculture is the most vulnerable sector to climate change. A number of factors of climate change including rainfall pattern, temperature hike, changes in sowing and harvesting dates, water availability, evapotranspiration and land suitability, affect agriculture productivity (Kaiser and Drennen, 1993).

There is growing body of evidences suggesting that the climate induced risks adversely affect the farm sector in a number of ways including declining yields, financial losses, damages to primary infrastructure (water channels, tube wells, storage houses including personal seed stock), machinery losses etc. (Aimin, 2010; Drollette, 2009; Raju and Chand, 2008; Jain and Parshad, 2007; Moschini and Hennessy, 1999). There are various types of risk management tools available for the farmers which are used to reduce the risk such as avoiding risk, preventing risk, sharing risk, transferring risk, spreading risk and taking risk (Singh, 2010). The literature also emphasized the potential role of these risk coping tools to avoid or minimize such losses. Examples of such studies include Ullah et al. (2016) for off-farm diversification and agricultural credit; Ullah et al. (2015) for diversification and precautionary savings; Ullah and Shivakoti (2014) for on-farm and off-farm diversification; Kouame (2010) for diversification, precautionary savings and social networks; Valendia et al. (2009) for Crop insurance, forward contracting and spreading sales and Ashfaq et al. (2008) for diversification.

However, adoption of these tools may put some cost on farmers. For example, adoption of off-farm diversification may require reallocation of limited farm resources to off-farm sector that may reduce productivity of farm sector (mainly due to diseconomies of scale). Similarly, asset accumulation may induce farmers to invest lower proportion of their wealth (or income) in farm enterprise than before causing a reduction in yield. Premium rate of crop insurance is another form of direct cost of risk mitigating tools. In case of forward contracts, the producers transfer risk to contractor and willing to accept lower current (but certain) revenues than future higher revenues with some degree of risk. These costs are, hereby, referred to as the cost of risk management and can be defined as “the cost incurred (explicit) or the benefits foregone (implicit) by adopting risk mitigating measures”.

Our contemporary review of the relevant literature revealed that previous studies have ignored such costs and focused mainly on effects of climatic risks on farm productivity and factors affecting the adoption of risk coping tools. This study is therefore an attempt to investigate the cost of adopting two risk coping tools i.e. off-farm diversification and precautionary savings among wheat growers in Khyber Pakhtunkhwa province of Pakistan. Understating of such cost will help in evaluating farmers’ behavior and attitude towards climatic risks as it is generally hypothesized that farmers adopt risk mitigating measures only when the benefits of adoption outweigh the costs associated with such adoption. This may provide a possible explanation on why some of the state owned risk coping tools (i.e. Crop Loan Insurance Scheme in Pakistan) failed to diffuse. The findings of this study will be of particular interest for researchers, policy makers, institutions serving agriculture particularly those targeting climatic risks and will contribute to fill the literature gap.

Materials and Methods

Study area and sampling

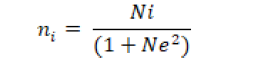

A multistage sampling procedure is adopted to select the study location and sample respondents. In the first stage four districts namely Peshawar, Charsadda, Swat and Shangla, of Khyber Pakhtunkhwa province of Pakistan were selected. Main reason behind the selection of these districts was the access of farmers in these districts to main markets and other publically provided services. District Peshawar (provincial capital) and district Charsadda are located in Peshawar valley where farmers have relatively higher access to main markets (both input and output) and other publically provided services including agricultural credit and information services. However, farmers in district Swat and Shangla have relatively lower access to these services (Ahmed et al., 2007; Shahbaz et al., 2010). In the second stage the union councils in each district were divided into two strata as severely affected and moderately affected by the flood in 2010. Two union councils from each selected district were selected randomly using stratified random sampling. In the third stage, one village in each union council (a total of 8 villages in 8 union councils) was selected at random. In the fourth stage a total of 330 farming households were randomly selected from the study area using Yamane’s (Yamane, 1967) formula as given below;

Where;

ni = Sample size in the ith Village; Ni= Total number of farming households in ith village; e=Precision which is set at 15% (0.15).

It should be noted that all the sampled respondents were wheat growers as wheat is a staple food item and is grown by almost all farmers in the selected districts.

Data collection

The selected respondents are interviewed for relevant information on farm size, credit amount and access, information access, their risk perception and risk attitude and their decisions of adopting the available risk management tools. The data was collected through face to face meetings at farmers’ field and/or home using a structured questionnaire during November 2012 to April 2013.

Estimation procedure

The present study is aimed at investigating the cost of adopting the two risk coping tools, namely off-farm diversification and precautionary savings, on farm productivity. It should be noted that farmers adopt multiple risk coping tools at the same time to protect their earnings and provide best safety net to their farm enterprise. Off-farm diversification and precautionary savings are the dominant risk coping strategies among a number of available risk coping strategies adopted by the sampled respondents in the study area and are therefore considered for the present study. These two risk coping tools make for different combinations i.e. (i) no risk management tool used, (ii) only off-farm diversification is used, (iii) only precautionary savings is used and (iv) both off-farm diversification and precautionary savings are used. The farmers can choose only one combination out of the four as these combinations are mutually exclusive and collectively exhaustive. Wheat yield is used to compare productivity of farmers using various combinations of the two risk coping tools as wheat was the only crop sown by all sampled respondents. Wheat yield of farmers using these four combinations are separately recorded and are compared using Analysis of Variance (ANoVA) as outline below.

Table 1: Analysis of variance procedure.

| SS | Df | MS | F | |

| Between groups (or “Factor”) |

SSB = ∑njx̅j²−Nx̅² |

dfB = r−1 |

MSB = SSB/dfB |

F = MSB/MSW |

| Within groups (or “Error”) |

SSW = SStot−SSB |

dfW = N−r |

MSW = SSW/dfW |

|

| Total |

SStot = ∑x²−Nx̅² |

dftot = N−1 |

Where; r is the number of treatments; nj, x̅j, sj for each treatment are the sample size; sample mean and sample standard deviation respectively; N is the total sample size and x̅ = ∑x/N is the overall sample mean.

The ANOVA test, however, do not inform us about which category differ from the rest and by how much. To know which sample mean, differ from other and the magnitude of difference we used post-hoc analysis as discussed under the following sub-heading.

Post-hoc analysis: Tukey HSD

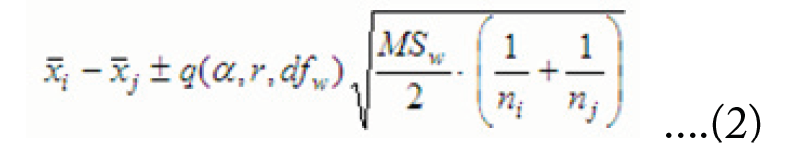

To determine which means are different, at our level of significance (α = 0.05) we used a post-hoc analysis. Among the various available post-hoc analysis techniques, we used Tukey HSD (Honestly Significant Difference) for our analysis. The Tukey’s HSD analysis form the following equation (Tukey, 1949);

Where;

x̅i and x̅j are the averages for two samples, ni and nj represents the two sample sizes, MSW is the within-groups mean square from the ANOVA table, the critical value of the studentized range for α is denoted by q while r is the number of treatments and dfw is the within-group degrees of freedom.

Results and Discussion

Frequencies of farmers adopting different combinations of the two risk coping tools along with their average wheat yield are presented in Table 2.

Table 2: Combinations of risk coping tools and average wheat yield.

| Farmer Category | Frequency | Average Wheat Yield (Kgs/ha) |

| No Risk Coping Tool is Adopted | 104 (31.515%) | 1765.548 |

| Only Off-farm Diversification is Adopted | 94 (28.484%) | 1521.181 |

| Only Precautionary Savings is Adopted | 49 (14.848%) | 1702.551 |

| Both Risk Coping Tools are Adopted Simultaneously | 83 (25.151%) | 1481.548 |

| Total | 330 (100%) | 1615.156 |

Source: Authors’ calculations from survey data.

Most of the farmers in the area adopted no risk coping tools and harvest the highest wheat yield compared to farmers using various combinations of the risk coping tools. Around 29 percent of the sampled respondents adopt only off-farm diversification to even out adverse consequences of climatic risks. Similarly, 15 percent of the sampled respondents use only precautionary savings to mitigate climatic risks at farm level and 25 percent adopt both these tools simultaneously. Ullah et al. (2015) found that the risk averse farmers seek to adopt multiple risk coping tools at a time. The simultaneous adoption of multiple tools can therefore be associated with farmers risk averse nature. These combinations are used as basis to compare the yield of wheat among the sampled farmers. The results from comparison of wheat yield using ANoVA are provided in the following Table 3.

Table 3: ANOVA results for comparison of wheat yield in the four categories of farmers.

| Sum of Squares | Df | Mean Square | F | |

| Between Groups | 5038287.098 | 3 | 1679429.033 | 9.953*** |

| Within Groups | 55006769.114 | 326 | 168732.421 | |

| Total | 60045056.213 | 329 |

Note: *** represents significant at 1% probability level.

The computed F-test value suggest that at least two means are significantly different and can be established that the average wheat yield of farmers using different combinations of the two risk coping tools are significantly different. To investigate further which mean is different from the other and the magnitude of differences, we used Tukey HSD analysis. The results of the Tukey HSD analysis are provided in Table 4.

Table 4: Post-hoc analysis of the differences in mean yields of farmers adopting various combinations of the risk management tools.

| Risk Management Tools Combinations | Mean Difference | Standard Error | Significance |

| Category1-Category2 | 244.367 | 58.459 | 0.000 |

| Category1- Category3 | 62.997 | 71.175 | 0.813 |

| Category1- Category4 | 283.999 | 60.459 | 0.000 |

| Category2- Category3 | -181.370 | 72.378 | 0.061 |

| Category2- Category4 | 39.632 | 61.870 | 0.919 |

| Category3- Category4 | 221.003 | 74.003 | 0.016 |

Note: Category 1 include no risk management tools adopted; in Category 2 only diversification is adopted; category comprised of only Precautionary Savings while Category 4 consists of both the risk management tools.

The difference between farmers using combination 1 (no risk coping tool used) and combination 2 (only off-farm diversification) is statistically significant which can be used (along with the positive sign of mean difference) as basis to establish that farmers with no risk coping tool in place produce significantly higher wheat yield compared to farmers using off-farm diversification only. The reallocation of farm resources to off-farm income generating activities may be a possible explanation for this. Intensified farming yield more farm output than reallocation of farm limited resources somewhere else in the economy. However, it is worth mentioning here that this resource reallocation to off-farm sector is a vital source of income augmentation for farm households. The productivity losses (and hence income losses) in farm sector can be (partly or fully) compensated by the income from the off-farm sector where the resources have been placed.

The positive sign in the mean difference of category 1 and category 3 revealed that farmers using no risk coping tools can produce more output per unit of land than farmers adopting precautionary savings to safeguard their farm earnings from catastrophes. Farmers’ behavior to retain money to meet future emergency requirements discourages the use of timely inputs and mechanized farming practices ultimately effecting current farm productivity compared to farmers who use their resources to provide timely inputs to their farm and thereby harvesting more benefits from farm sector. This difference is, however, statistically insignificant.

Farmers using no risk management instrument produces significantly higher wheat grains per unit of area compared to farmers who use off-farm diversification and precautionary savings simultaneously. The simultaneous use of these two tools discourage higher wheat yields as part of the farm limited resources are reallocated to off-farm sector while a proportion is saved for future needs. The remaining resources are allocated to farm sector which are, generally, insufficient to provide the needed inputs in timely manner and farmers have to forego additional output to safeguard their future farm incomes.

The difference between category 2 and category 3 farmers is negative indicating that farmers adopting off-farm diversification are producing significantly lower wheat yields compared to farmers holding part of their assets/wealth for future emergency needs particularly for a situation where their farm incomes are altered by negative shocks arising from adverse weather conditions.

There is a non-significant difference in average wheat yield of farmers in category 2 and farmers in category 4. Farmers using only off-farm diversification produce 39.632 kgs/ha more output compared to farmers using both off-farm diversification and precautionary savings. Similarly, category 3 farmers produce significantly higher output per unit of area compared to category 4 farmers. The simultaneous adoption of off-farm diversification (resource reallocation) and precautionary savings (reduced current investment in farm sector) lead to sizeable losses in productivity of wheat. These losses are attributed to the cost of risk management at farm level.

Conclusions and Recommendations

Agricultural production is subjected to a wide array of climate induced risks including rising temperature, changing rainfall pattern, frequent floods, heavy rains and droughts. These events are generally beyond the control of farmers and lead to sizeable losses in agricultural production. Agricultural producers use a number of tools to mitigate (or minimize) the potential impacts of such risks at farm level. The use of these tools however put some cost (explicit) on farmers or require the farmers to forego part of the potential benefits (implicit). This is known as the cost of risk management. Because of the growing instability in agricultural production mainly due to climate change and the risk averse nature of the farmers, adoption of multiple risk coping tools simultaneously is common practice among farming community. However, simultaneous adoption of multiple risk coping tools increases these costs. The more a farmer is protecting himself/herself from catastrophic risks the higher cost s/he will pay. Future research on climatic risks management in agriculture should focus on finding ways to minimize these costs without compromising much on farm productivity.

Author’s Contribution

The leadiing author (Raza Ullah) has designed the study and provide theoretical background and analyzed the data while the co-author (Jamal Shah) helped in data collection, data entry and write up phase.

References

Ahmad, S., M. Jamal, A. Ikramullah and Himayatullah. 2007. Role of extension services on the farm productivity of district Swat: A case study of two villages. Sarhad J. Agric. 23(4): 1265-1272.

Aimin, H. 2010. Uncertainty, risk aversion and risk management in agriculture. Agric. Agric. Sci. Procedia. 1: 152-156. https://doi.org/10.1016/j.aaspro.2010.09.018

Ashfaq, M., S. Hassan, M.Z. Naseer, I.A. Baig and J. Asma. 2008. Factors affecting farm diversification in rice-wheat. Pak. J. Agric. Sci. 45(3): 91-94.

Drollette, S.A. 2009. Managing production risk in agriculture. department of applied economics utah state university. AG/ECON/2009‐03RM.

Jain, R.C.A. and M. Parshad. Working group on risk management in agriculture for xi five year plan (2007 – 2012). Govt. India, Plann. Comm. New Delhi.

Kaiser, H.M. and T.E. Drennen. 1993. Agricultural dimensions of global climate change. Delray beach, FL: St. Lucie press.

Kouame, E.B.H. 2016. Risk, risk aversion and choice of risk management Strategies by cocoa farmers in western Cote D’ivoire. University of Cocody-aerc collaborative PhD program (2010). Available online on http://www.csae.ox.ac.uk/conferences/2010-EDiA/papers/267-Kouame.pdf. Retrieved 14th February, 2016.

Moschini, G. and D.A. Hennessy. 1999. Uncertainty, risk aversion and risk management for agricultural producers. Staff Paper No. 319.

Raju, S.S. and R. Chand. 2008. Agricultural insurance in India problems and prospects. NCAP working paper no. 8. national center for agricultural economics and policy research. India. Counc. Agric. Res. New Delhi.

Shahbaz, B., T. Ali, I.A. Khan and M. Ahmad. 2010. An analysis of the problems faced by farmers in the mountains of northwest Pakistan: Challenges for agricultural extension. Pak. J. Agric. Sci. 47(4): 417-420.

Singh, G. 2010. Crop insurance in India. Working paper no. 2010-06-01. India. Inst. Manage., Vastrapur, Ahmedabad – 380 015.

Tukey, J. 1949. Comparing individual means in the analysis of variance. Biometrics. 5(2): 99–114. JSTOR 3001913.

Ullah, R., G.P. Shivakoti, M.A. Kamran and F. Zulfiqar. 2016. Farmers vs. Nature: Managing disaster risks at farm level. Natural hazards: http://link.springer.com/article/10.1007/s11069-016-2278-0

Ullah, R., D. Jourdain, G.P. Shivakoti and S. Dhakal. 2015. Managing catastrophic risks in agriculture: Simultaneous adoption of diversification and precautionary savings. Int. J. Disaster Risk Reduct. 12. 268–277. https://doi.org/10.1016/j.ijdrr.2015.02.001

Ullah, R. and G.P. Shivakoti. 2014. Adoption of on-farm and off-farm diversification to manage agricultural risks: Are these decisions correlated? Outlook on Agric. 43(4): 265-271. https://doi.org/10.5367/oa.2014.0188

Velandia, M., R.M. Rejesus, T.O. Knight and J. Sherrick. 2009. Factors affecting farmers’ utilization of agricultural risk management tools: The case of crop insurance, forward contracting and spreading sales. J. Agric. Appl. Econ. 41(1): 107-123. https://doi.org/10.1017/S1074070800002583

Yamane, T. 1967. Statistics, an introductory analysis (2nd ed.). New York: Harper and Row.